2022 is a magical year, with the world in turmoil and witnessing many historic moments. The global economy is gradually declining, and the cryptocurrency industry is also facing a winter. However, the real crisis has yet to come. With the increasing regulatory scrutiny of the cryptocurrency industry, the true potential crisis is gradually emerging. Starting from August 8, 2022, when the US Department of the Treasury announced that decentralized cryptocurrency mixing service Tornado Cash would be included in the OFAC's SDN List, a war between decentralization and centralization has begun!

*This article is for personal analysis only and does not constitute any investment advice. If there is any incorrect content, please feel free to point it out.

Author: 菠菜菠菜

Table of Contents#

1. The Beginning of the "War" between Centralization and Decentralization#

(1) What is OFAC?

(2) What is Tornado Cash? Why was it sanctioned?

(3) What are the consequences of the sanctions on Tornado Cash?

2. Ethereum Faces Historic Regulatory Risks - On-Chain Surveillance#

(1) Ethereum is Facing "Control"

(2) How will Ethereum be "controlled"?

(3) How will Ethereum respond to regulation?

-

With the implementation of sanctions on Tornado Cash, a privacy mixing protocol running on the blockchain, a "war" between centralization and decentralization has begun. However, the sanctions did not achieve their intended purpose.

-

After being sanctioned, Tornado Cash's website was blocked, and other DeFi protocols, under legal pressure, prohibited frontend interactions with addresses related to the Tornado protocol. The issuer of USDC also blacklisted and froze the sanctioned wallets. However, Tornado Cash's smart contracts continue to operate on the Ethereum blockchain and users can still interact with them.

-

The sanctions on Tornado Cash by OFAC have caused a series of chain reactions. A large-scale "poisoning" event has begun, with numerous addresses being "poisoned" and banned by DeFi protocols, and MakerDAO founder Rune is planning to sell all USDC in MakerDAO and replace it with ETH as collateral, fearing that MakerDAO will be blacklisted and collapse.

-

Currently, Ethereum's beacon chain is relatively centralized, with the top validators holding over 66% of the total stake. These validators are operated by entity node operators and face regulatory pressure. If OFAC starts to conduct on-chain surveillance on Ethereum, it will be "controlled" and lose its decentralization and resistance to censorship, which will have a serious impact on the industry.

-

OFAC can achieve true sanctions on addresses on the blockchain by controlling validators operated by entity node operators. By monitoring the requests sent by the sanctioned addresses and rejecting blocks containing these requests, the sanctioned addresses will be unable to perform any operations and their assets will become worthless, causing Ethereum to lose "private property ownership."

-

The Ethereum community has initiated a voting discussion. Most people, including Ethereum founder Vitalik, support viewing the surveillance of Ethereum as an attack and punishing the validators by burning their stakes.

1. The Beginning of the "War" between Centralization and Decentralization#

(1) What is OFAC?

OFAC stands for the Office of Foreign Assets Control of the US Department of the Treasury. Its mission is to administer and enforce economic and trade sanctions based on US national security and foreign policy. It primarily implements economic sanctions programs against countries and individuals, such as terrorists. Sanctions can be comprehensive or selective, using asset blocking and trade restrictions to achieve foreign policy and national security goals. The SDN List is OFAC's list of sanctioned individuals and entities.

(2) What is Tornado Cash? Why was it sanctioned?

In simple terms, Tornado Cash is a privacy-preserving mixing protocol running on Ethereum. It is mainly used to hide transaction trails. The basic principle is that users transfer assets to the Tornado protocol and receive a password. The recipient only needs to enter this password to retrieve the assets from the Tornado protocol. This avoids direct interaction with the sender's wallet, making it extremely difficult to trace the flow of funds. However, Tornado Cash has become a haven for illicit actors to hide illicitly obtained assets, which caught the attention of the US government and led to sanctions.

(3) What are the consequences of the sanctions on Tornado Cash?

This is the first time in history that smart contracts on the blockchain have been sanctioned by OFAC. Tornado Cash's website was blocked due to the sanctions, and Circle, the issuer of USDC, blacklisted and froze the sanctioned addresses' USDC to comply with the legal requirements. Even DeFi protocols like AAVE and Uniswap began to respond to the sanctions by prohibiting interactions with Tornado Cash smart contracts.

However, the actual impact is quite dramatic. Although the frontend of Tornado Cash's website was blocked, the smart contracts continue to operate on the Ethereum blockchain and cannot be stopped. Users familiar with contract interactions can still directly interact with the Tornado Cash smart contracts. The sanctions on the website only increase the barrier to entry, but do not actually prevent Tornado Cash from operating. Mirror websites and Tornado websites running on IPFS have even emerged.

The sanctions on Tornado Cash have triggered a series of chain reactions. Despite the website being blocked, the smart contracts continue to operate, and users can still interact with them. A "poisoning drama" has unfolded, with many Tornado Cash users sending assets from the smart contracts to the wallets of whales or celebrities, leading to the contamination of a large number of wallets and subsequent sanctions. Rune, the founder of MakerDAO, revealed on August 13, 2022, that he received 0.1 ETH sent through the Tornado Cash smart contract, resulting in his wallet being banned by AAVE. Although AAVE has started to lift some of the bans on affected addresses, the "poisoning drama" is still ongoing.

The issuer of USDC, Circle, blacklisting and freezing the assets of the sanctioned addresses has had the most significant impact. This blatant violation of personal asset security by centralized institutions has raised concerns about the safety of personal assets. The external value of the entire cryptocurrency market is mainly derived from centralized stablecoins such as USDT and USDC. The ability of these stablecoin issuers to arbitrarily freeze assets in any wallet poses a serious threat. Although there have been many instances of blacklisting individual accounts, this time the contract addresses were directly sanctioned, which is very serious. It means that any smart contract using USDC can be sanctioned, as well as the addresses of users who have interacted with the contract.

Rune, the founder of MakerDAO, realized this risk and initiated a discussion on Discord on August 11, 2022. Since USDC accounts for the largest proportion of collateral in MakerDAO, if the issuer of USDC is sanctioned and instructed to freeze USDC in MakerDAO, MakerDAO will collapse, and the decentralized stablecoin DAI will go to zero, triggering a series of chain reactions. Rune proposed to replace all USDC in MakerDAO with ETH as the main collateral, but this decision carries great risks, as the volatile nature of ETH could also lead to the collapse of MakerDAO, putting MakerDAO in a difficult situation.

The sanctions on Tornado Cash have opened the "war" between centralization and decentralization. Although Tornado Cash continues to operate on Ethereum and the sanctions did not achieve their intended purpose, they have triggered a series of chain reactions. However, I believe that the sanctions on Tornado Cash are just the beginning, and the decentralized world will face more regulatory challenges in the future!

2. Ethereum Faces Historic Regulatory Risks - On-Chain Surveillance#

(1) Ethereum is Facing "Control"

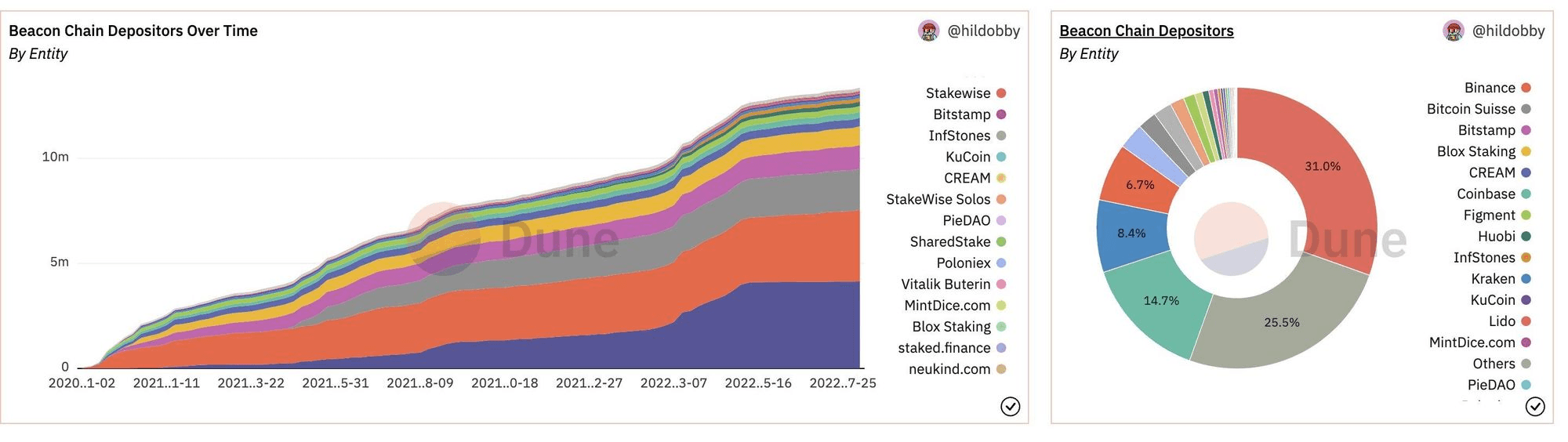

With the upcoming "The Merge" of Ethereum 2.0, Ethereum is facing a transition from the Proof-of-Work (PoW) consensus mechanism to the Proof-of-Stake (PoS) mechanism. However, the current beacon chain, which operates on the PoS mechanism, is still relatively centralized. The top validators on the beacon chain already hold over 66% of the total stake, and these validators are operated by entity node operators. What does this mean?

Data source: Dune analytics

First, let's understand the block production mechanism under the PoS mechanism. In simple terms, a block needs to be approved by over two-thirds (66% or more) of the total stake in the network through a validation vote before it can be confirmed. Therefore, having control over 66% of the stake means having the power to decide which blocks are produced.

Now that we understand the conditions for controlling Ethereum's block production, let's imagine: the top validators are operated by entity node operators, which means these operators will face legal and regulatory risks. If the validators with over 66% of the stake on the beacon chain receive instructions from OFAC to implement surveillance on Ethereum, what will happen?

This means that OFAC can arbitrarily sanction any address on Ethereum. This is true sanctions on private property ownership, rather than just blacklisting addresses by stablecoin issuers or banning frontend interactions. This means that the so-called decentralization and resistance to censorship in blockchain will become a joke, and it may even lead to the collapse of the entire industry's beliefs.

(2) How will Ethereum be "controlled"?

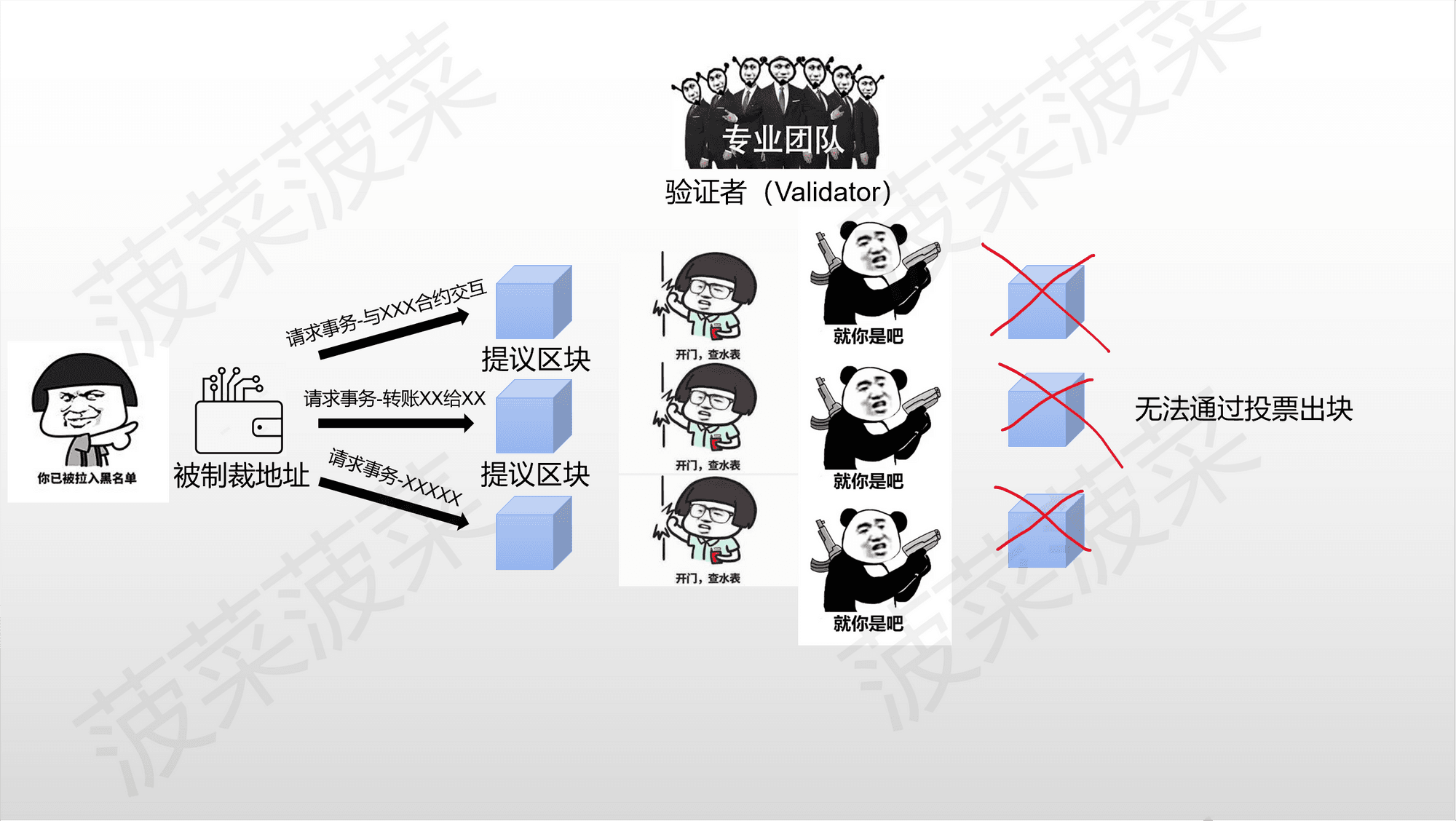

Ethereum's PoS mechanism has a highly secure punishment mechanism to prevent malicious behavior by validators, with the highest penalty being the loss of all stakes. Even launching an attack with over 51% of the stake would not be worth it. However, the situation Ethereum is facing now is completely different. It is not about validators "misbehaving," but about targeted sanctions on addresses on the blockchain. This would trample on the concept of private property ownership.

The definition of validators "misbehaving" is when they tamper with blockchain data, propose multiple different blocks, or vote for different blocks. However, targeted sanctions on addresses only require monitoring the transactions sent by the sanctioned addresses and rejecting blocks containing these transactions. When a block fails to receive over 66% of the stake's validation votes, all transactions in that block will be rolled back. This means that the sanctioned addresses will be unable to perform any operations, and the assets in those addresses will become worthless. Validators will not face any punishment.

(3) How will Ethereum respond to regulation?

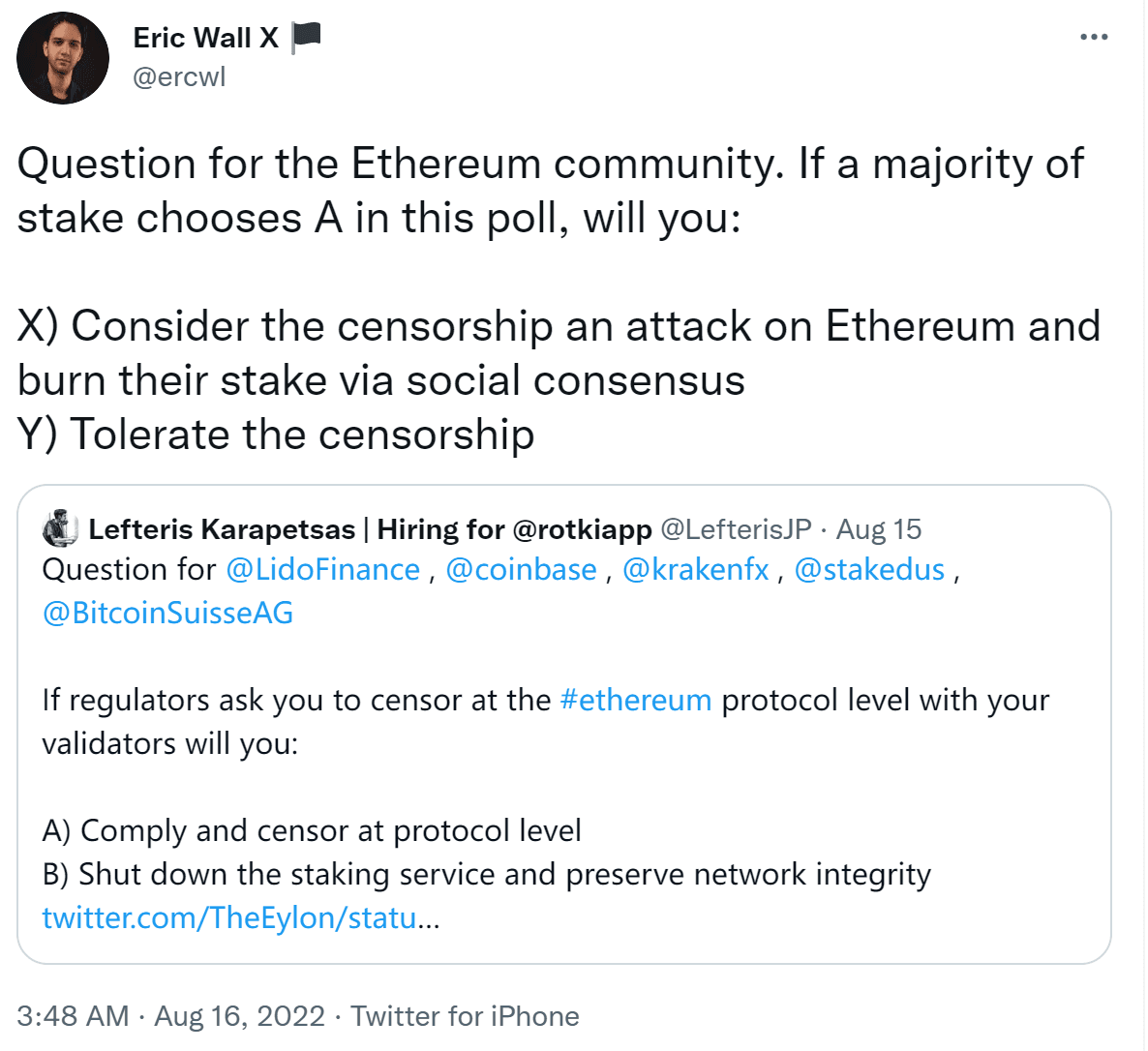

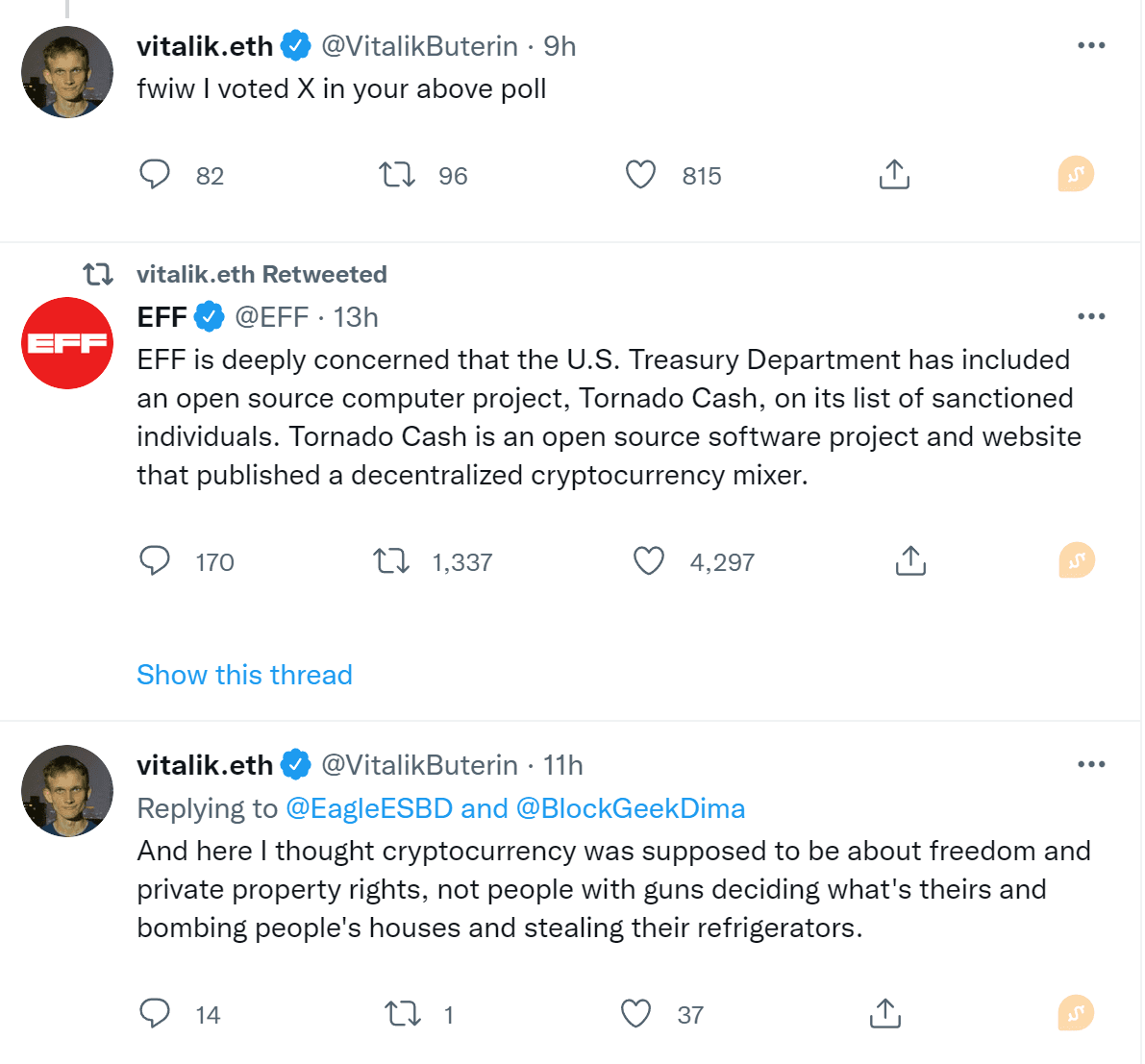

On August 16, 2022, the Ethereum community initiated a voting discussion on Twitter about how to respond if OFAC starts to conduct surveillance on Ethereum through validators.

-

X) View this surveillance system as an attack on Ethereum and burn the stakes of these validators through widespread consensus.

-

Y) Tolerate the surveillance system.

Ethereum founder Vitalik expressed his position below, stating that Ethereum will view this surveillance as an attack and punish the validators to prevent Ethereum from being "controlled." Vitalik also stated that the crypto world should be free and have private property rights, rather than allowing those with "guns" to blow up other people's houses and steal their refrigerators.

The "war" between centralization and decentralization has begun, and currently, the majority of people agree with the Ethereum community's view of the surveillance system as an attack. However, there is no detailed plan on how to achieve the so-called widespread consensus to punish the validators implementing the surveillance system. One thing is certain: the next developments will be a game between centralization and decentralization. ETH holders should always be aware of the risks. If regulation comes, can Ethereum hold onto its so-called "private property ownership"? If Ethereum compromises with the surveillance system, where will Ethereum go? Let's wait and see!