Author | Bocai Bocai

Twitter | @wzxznl

Is the stablecoin BUSD with a market value of hundreds of billions shutting down? How influential is the United States in the cryptocurrency industry? What does the suspension of BUSD mean? How important are stablecoins? What is the significance of stablecoins? Let's talk about stablecoins, which everyone is familiar with, and hopefully, it can deepen people's understanding of stablecoins.

The following content is all personal opinions and understanding. If there are any errors or different ideas, please feel free to provide feedback.

Original link:

⇒ Stablecoins: Essential Assets in Cryptocurrency

If we talk about what is most widely used in the cryptocurrency world and held by the most people, is it Bitcoin? Ethereum? No, it's stablecoins, which we commonly refer to as "U".

What does a newcomer do when they want to buy cryptocurrency? They usually buy U on an exchange.

What do people usually do when they think the market is going to crash? They exchange their coins for U as a safe haven.

What do people usually do when a pump and dump scheme is about to exit? They sell their coins for U.

It seems that everyone in the cryptocurrency world can't do without stablecoins, but do we really understand stablecoins? Why are stablecoins "stable"? What is the significance of stablecoins?

First, let me answer these questions for you, and then we'll talk about BUSD.

⇒ The Significance of Stablecoins in Cryptocurrency

First, let's talk about the significance of stablecoins. Imagine a cryptocurrency world without stablecoins.

If stablecoins didn't exist, and I wanted to buy Bitcoin with fiat currency, the purchasing process might be as follows: The seller provides a payment channel—I transfer money to the seller's payment channel—I provide a wallet address—the seller transfers BTC to my address. This whole process would take more than ten minutes or even dozens of minutes. Just the confirmation of a Bitcoin transaction would take at least ten minutes (confirming one block in ten minutes). If it's an over-the-counter transaction, there is a risk of the seller running away. Also, due to the high volatility of cryptocurrency assets, there may be drastic fluctuations within a few minutes. For example, I might spend $10,000 to buy one Bitcoin, but by the time it reaches me, it has already dropped to $8,000. Not only is there a long waiting time, but there are also many unstable factors. For institutions with large amounts of funds, it would be difficult to find corresponding counterparties, and it would be troublesome to sell.

With stablecoins, people can convert fiat currency into stablecoins and store them in wallets. With stablecoins as a low-volatility value medium, people can trade other cryptocurrencies on trading platforms at any time. This creates a stable trading medium between different cryptocurrencies with different levels of volatility. For institutions with large amounts of funds, it provides a safe and stable medium.

Therefore, the significance of centralized stablecoins lies in their low volatility. They not only serve as a store of value during market volatility but also act as a trading medium on trading platforms, greatly improving trading efficiency. They provide a safe value medium for the entire cryptocurrency market, allowing it to handle larger amounts of funds.

⇒ Intrinsic Differences of Stablecoins

So, how do stablecoins maintain their "stability"? What is the difference between centralized stablecoins and decentralized stablecoins?

Let's start with the most important centralized stablecoins:

Centralized stablecoins are issued on the blockchain by centralized issuing institutions through off-chain asset collateral. In simple terms, these institutions issue stablecoins on the blockchain based on the amount of dollars they hold in banks, guaranteeing a 1:1 exchange rate.

Stablecoins like USDT, USDC, and the protagonist of this incident, BUSD, are all centralized stablecoins. These three stablecoins dominate the stablecoin market. We can think of these stablecoins as on-chain vouchers for the dollars held by institutions. With these vouchers, we can exchange them back for real dollars from the institutions at a 1:1 ratio. This is why centralized stablecoins are "stable". The institutions only need to ensure that they have enough dollars for redemption.

Decentralized Stablecoins

As for decentralized stablecoins, I categorize them as stablecoins generated by smart contracts rather than centralized institutions. Decentralized stablecoins can be further divided into over-collateralized stablecoins and algorithmic stablecoins (like the collapsed UST). Of course, there are also stablecoins that combine over-collateralization and algorithms. However, I will mainly introduce over-collateralized stablecoins, such as the well-known DAI and the upcoming GHO and crvUSD.

As the name suggests, over-collateralized stablecoins can only be generated with over-collateralization. For example, in MakerDAO, if I collateralize $100 worth of Ethereum, I can only generate $65 worth of DAI, relying on smart contracts for liquidation and governance. Apart from the difference in issuing entities, centralized stablecoins and decentralized stablecoins also differ in functionality and purpose.

-

Difference 1: The issuance of centralized stablecoins means that real money from the external world has flowed into the cryptocurrency world, expanding the scale of funds (under the condition of collateralization, not printing money out of thin air). On the other hand, the issuance of over-collateralized stablecoins currently does not lead to an expansion of the market scale. This is related to the way they are generated. Essentially, over-collateralized stablecoins are generated by locking the liquidity of collateral, and they do not belong to the funds entering the cryptocurrency world from the external world.

-

Difference 2: Due to the centralized issuing institutions behind centralized stablecoins guaranteeing their value with collateralized fiat currency, centralized stablecoins can act as a "safe haven" during market volatility. On the other hand, if over-collateralized stablecoins use volatile assets as collateral, they will face significant liquidation risks during market volatility and cannot serve as a safe store of value.

⇒ Centralized USD Stablecoins Dominate Cryptocurrency

If centralized stablecoins are used as collateral, then these over-collateralized stablecoins are more like a kind of centralized stablecoin in disguise. Therefore, the significance of over-collateralized stablecoins is more like a leverage tool. People use collateralized assets to obtain over-collateralized stablecoins to increase asset leverage and capital utilization efficiency. They can use the over-collateralized stablecoins generated from collateral to repurchase volatile assets or earn interest.

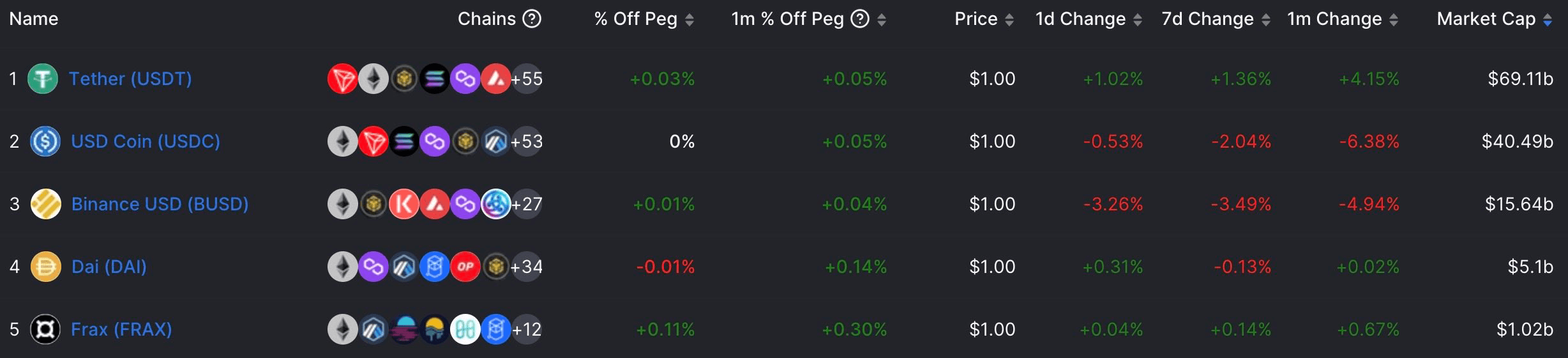

Let's look at the market share of stablecoins. The combined market value of the three major centralized stablecoins, USDT, USDC, and BUSD, is in the hundreds of billions. On the other hand, the market value of the largest decentralized stablecoin, DAI, is only around $5 billion. Compared to centralized stablecoins, DAI is like a little brother. Therefore, after all this, it is clear that in the world of stablecoins, centralized USD stablecoins are the dominant players.

⇒ How Influential is the United States in the Cryptocurrency Industry?

You may notice a phenomenon that stablecoins are almost always denominated in US dollars. This is because the United States has the dominance of the US dollar. What is the dominance of the US dollar? It means that the United States can exchange its printed paper or add some numbers digitally to obtain goods or services from other countries. It can also transfer crises to the global economy and enjoy certain privileges unique to the United States.

The dominance of the US dollar is a big topic. Understanding the dominance of the US dollar and the US dollar tide will help you understand why Bitcoin surged to $60,000 in a bull market and why we are currently experiencing a bear market due to the US dollar's interest rate hikes and balance sheet reduction. If you want to further understand this, you can read a research report on the dominance of the US dollar and stablecoins written by me and @BirkSamo.

Is the Mainstream Stablecoin an Extension of US Dollar Dominance?

https://mirror.xyz/bocaibocai.eth/\_66d8wRKfs7ZYBfqgMOHH4Lm3GWrRfWg-7fkzU-hMPQ

The conclusion of the research report is that stablecoins, as representations of real-world dollars, are the best bridge for the dominance of the US dollar to influence the cryptocurrency world. Therefore, since the top three stablecoins are all collateralized with the US dollar, they are naturally subject to US regulations. Moreover, the issuers of USDC and BUSD, Circle and Paxos, are licensed institutions in the United States (naturally, they have to listen to the boss on US territory).

Even the issuer of USDT, Tether, which is not based in the United States, cannot escape US jurisdiction. Tether was fined $41 million by the U.S. Commodity Futures Trading Commission for concealing reserve information. So, we understand that these stablecoin issuers have to listen to the United States. If they don't, the United States has many ways to deal with them.

⇒ Why Specifically BUSD?

You may feel the influence of the United States in this incident where BUSD was suspended. A stablecoin with a market value of hundreds of billions, BUSD, can be shut down just like that. So why specifically BUSD? Personally, I think it has something to do with SBF, with a bit of politics and personal grudges.

I believe everyone is aware of the collapse of the FTX empire. Many people couldn't withdraw their assets from the FTX exchange, causing significant negative impacts.

SBF has close ties to the U.S. political arena. After SBF got into trouble, there were revelations: about 37% of U.S. congressmen have received political donations from SBF, including the newly elected Speaker of the U.S. House of Representatives, McCarthy. So, it's not hard to imagine how many politicians have their assets in FTX or have invested in projects related to SBF. It's also not hard to imagine how much these politicians have lost due to the collapse of FTX.

If we visit the official website of Paxos, the issuer of BUSD, we can see that besides BUSD, there is another stablecoin called USDP. So why was only BUSD targeted? It's hard to exclude the fact that this is targeting Binance. Some people may say that Binance engaged in unauthorized issuance and other illegal activities. But what if the issuer of USDC, Circle, did the same? Would the outcome be the same as BUSD? Or would they just pay a fine and regulate their operations? Currently, it seems that the United States does not want to completely eliminate stablecoins but simply does not want Binance to continue to dominate the stablecoin market.

⇒ What Does the Suspension of BUSD Mean?

In my opinion, it means the further consolidation of the United States' influence and control in the cryptocurrency world. Why do I say this? I believe that in the cryptocurrency world, whoever controls stablecoins also controls the narrative and even has the power to determine the life or death of certain protocols. Why do I say this? Can decentralized stablecoins escape U.S. jurisdiction? Let me explain one by one.

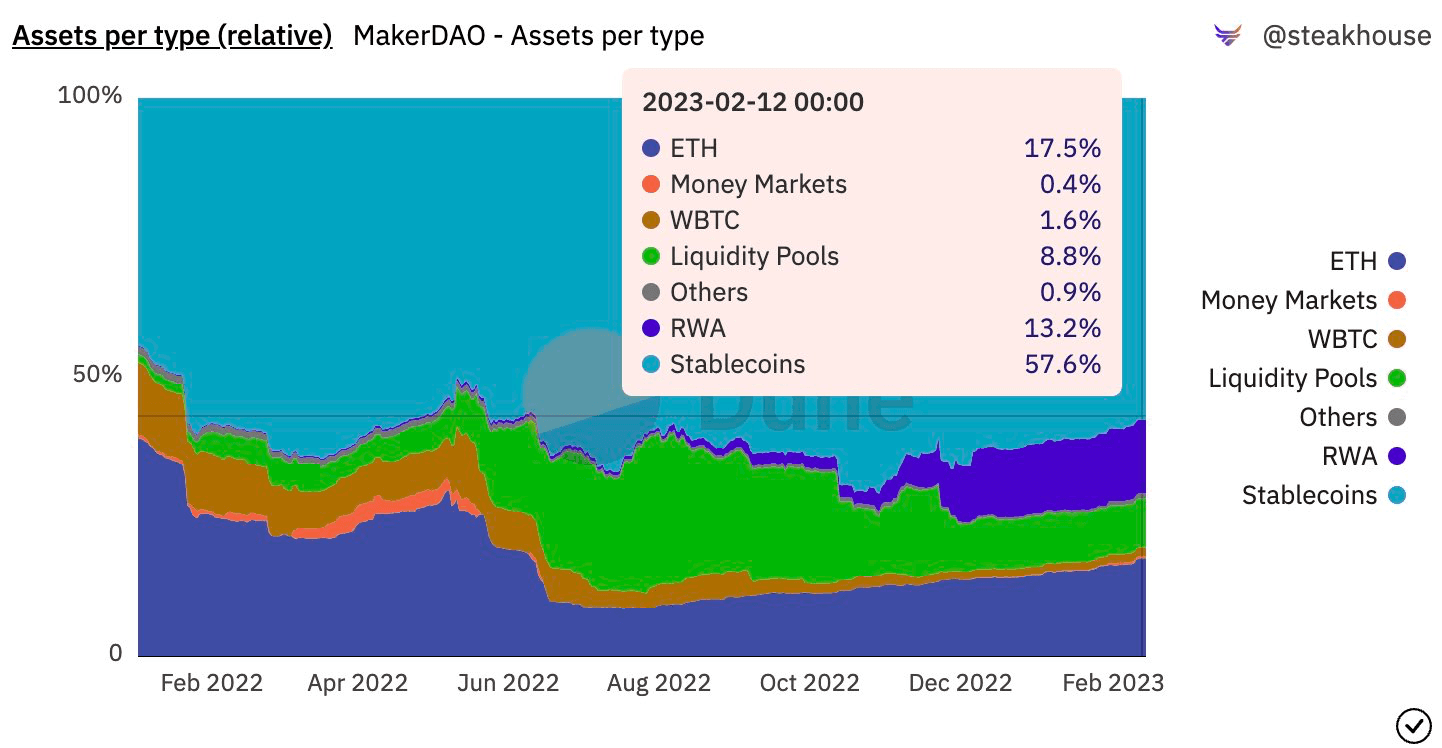

Here's a fact: Currently, 60% of the collateral for the largest decentralized stablecoin, DAI, is stablecoin USDC. What does this mean? It means that DAI's ability to maintain a peg to the US dollar to a large extent depends on USDC. If the collateral were volatile assets, DAI would easily decouple in extreme market conditions. Once stablecoins decouple significantly, it becomes difficult for people to continue to trust and use them.

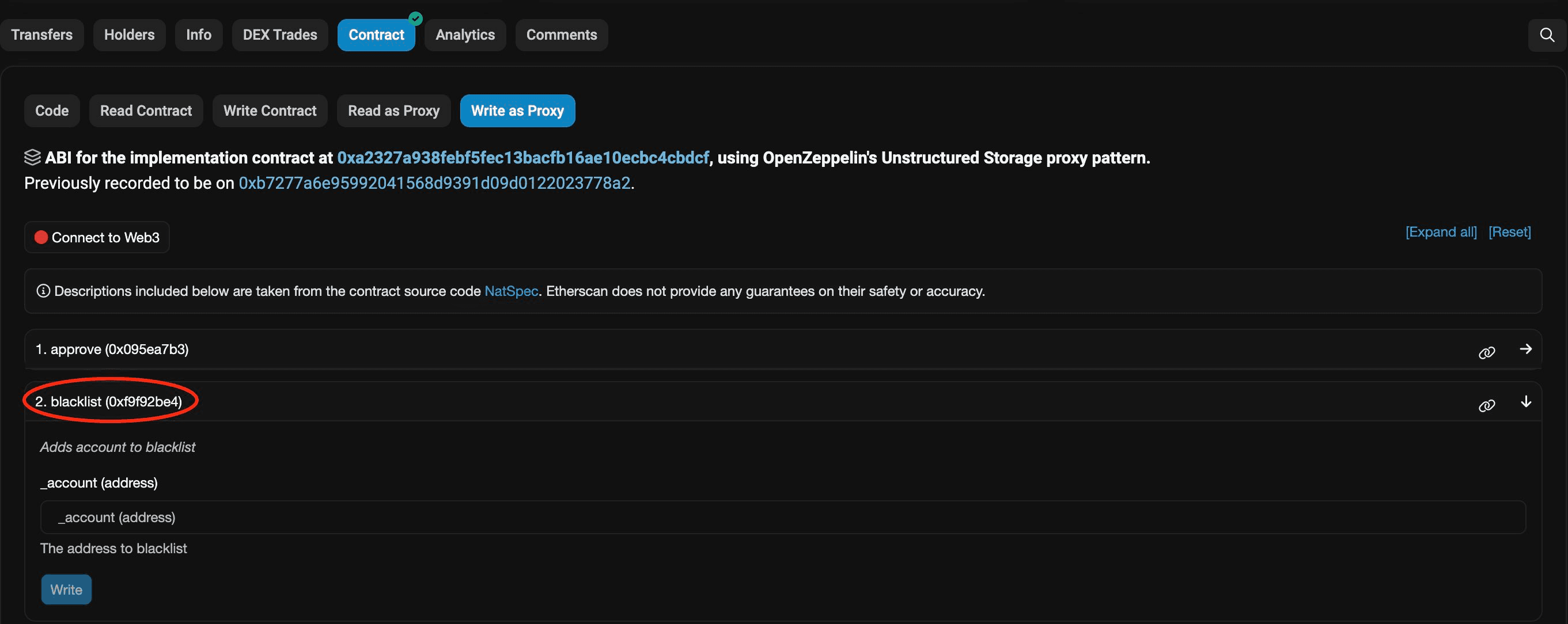

So, why do I say that controlling stablecoins also means having power over certain protocols? If we open the Ethereum blockchain explorer and find the smart contract of USDC, we will see a function called Blacklist. What is it for? Yes, it's a blacklist that can blacklist any address on the Ethereum network, including protocols.

Once an address is blacklisted, all USDC on that address will be frozen and unable to perform any operations. Imagine what would happen if the United States asked USDC to blacklist the MakerDAO protocol. This is the terrifying power of stablecoins. If the United States wants, it can blacklist any address they want to sanction through stablecoin issuers, even on the BSC chain.

So, this incident not only means that Binance lost a stablecoin, but also means that it lost its narrative power. If the cryptocurrency world wants to achieve true decentralization and resistance to censorship, it needs stablecoins that are not tied to the US dollar and not controlled by the United States. However, it is extremely difficult to achieve this under the backdrop of the dominance of the US dollar. MakerDAO has also realized this problem and has started a plan to move towards true decentralization and break free from the US dollar.

⇒ The Stalemate Will Eventually Be Broken

Although it seems that the cryptocurrency world is going against the "decentralized spirit," it is difficult for us, who were born at this time, to grasp the development of technology. Just as people in the era of horse-drawn carriages could not imagine the future where cars replaced carriages, or how users of the old internet in the PC era underestimated the disruption brought by mobile internet, the big shots of Web2 entering Web3 will also experience various discomforts. The charm of this industry lies in its astonishing speed of iteration.

From the earliest BTC, to the "blockchain world," and now to the "cryptocurrency world," we are not just iterating on promotional terms, but also witnessing the rapid development of technology.

With massive capital investment and more and more builders migrating into the industry, the future will undoubtedly surpass the imagination of all of us. Perhaps in a few years, the current stalemate will be resolved in unexpected ways.