Credit is one of the most important components in the operation of the economic machine. Lenders hope that money will generate interest, while borrowers want to purchase something they cannot currently afford. The lending relationship between lenders and borrowers is based on trust. Credit is also a primary source of income for banks in traditional finance, where people deposit their funds in banks to earn interest. Banks then lend the deposited money to borrowers in need of funds, charging higher interest to profit from the interest rate spread between the two. Large-scale credit is typically facilitated by banks as centralized institutions, but with the rapid development of blockchain technology, humanity's credit model is undergoing a revolutionary change. The decentralized "bank" AAVE has emerged.

The banking model can be traced back to Babylon around 2000 BC, where temples were already engaged in activities such as safeguarding gold and silver, issuing loans, and collecting interest. In Greece around 500 BC, Athens around 400 BC, and the Roman Empire around 200 BC, we can find the early forms of primitive banking. The traditional credit model has persisted for thousands of years, but with the birth of the decentralized "bank" AAVE, humanity can now achieve large-scale credit without the need for a centralized institution, ensuring the safety of funds for both lenders and borrowers, as well as balancing supply and demand.

This article is for personal analysis only and does not constitute any investment advice. Please feel free to point out any inaccuracies.

Author: Spinach Spinach

Table of Contents#

1. AAVE—The King of DeFi Lending#

(1) What is AAVE?

(2) How does AAVE disrupt traditional lending models?

(3) How to profit from AAVE?

2. What functions and mechanisms does AAVE have?#

(1) How does AAVE's interest rate model change according to market demand?

(2) How does AAVE conduct liquidations?

(3) What is the Credit Delegation mechanism?

(4) What is a Flash Loan?

3. What is the AAVE Token? What can it be used for?#

(1) AAVE Economic Model

(2) What can Aave Token be used for?

(3) What is the AAVE Safety Module?

4. The New Challenger of Decentralized Stablecoins—GHO#

(1) What is the decentralized stablecoin GHO?

(2) Why does AAVE want to create a stablecoin? Can it surpass DAI?

- AAVE is a decentralized, non-custodial liquidity market protocol where depositors (liquidity providers) provide liquidity by depositing assets into AAVE's public pool to earn passive income. Borrowers can freely borrow assets from the pool using various methods, either over-collateralized or uncollateralized.

- In traditional finance, credit activities often require credit checks on borrowers and come with repayment deadlines. The emergence of AAVE allows credit activities to proceed without any credit checks, and its high liquidation efficiency significantly reduces the likelihood of bad debts compared to traditional lending models. Additionally, borrowing on AAVE does not have repayment deadlines.

- Users can engage in stablecoin leverage arbitrage on AAVE to earn more returns, and they can also seek interest rate differentials or price discrepancies across different DeFi platforms using Flash Loans for arbitrage, leveraging their volatile assets to amplify returns, and more.

- AAVE's interest rate model allows deposit and borrowing interest rates to change with market supply and demand. When more people borrow, deposit rates and loan interest rates rise to encourage deposits and reduce borrowing. Conversely, when fewer people borrow, deposit and loan interest rates fall to encourage borrowing.

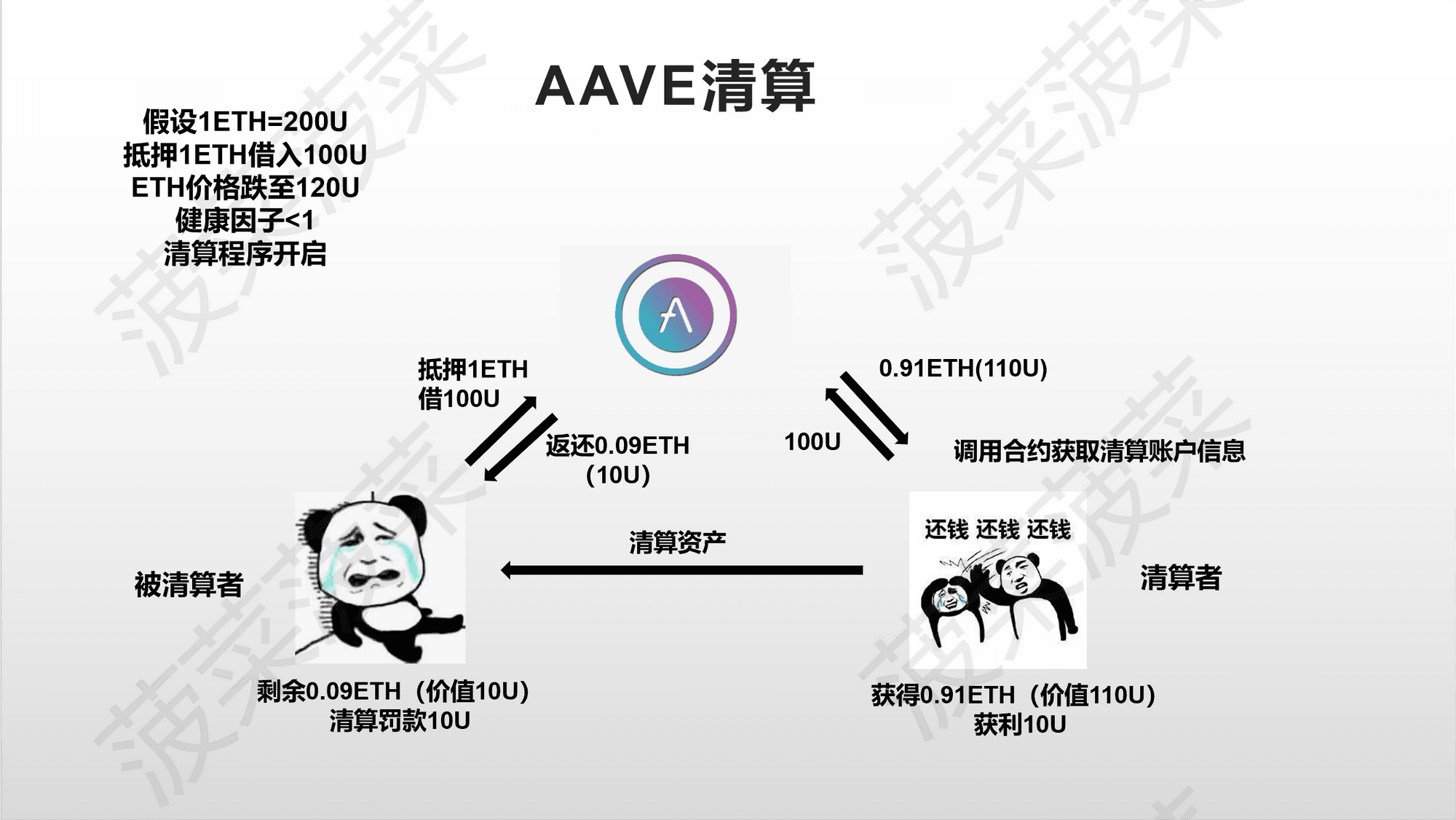

- The smart contracts of the AAVE protocol cannot automatically perform liquidation operations, so AAVE's liquidation process requires third parties to complete it. Liquidators must call AAVE's liquidation smart contract to obtain information about accounts facing liquidation and execute the liquidation operation. The liquidated party must pay an additional liquidation penalty to incentivize more people to participate in liquidations.

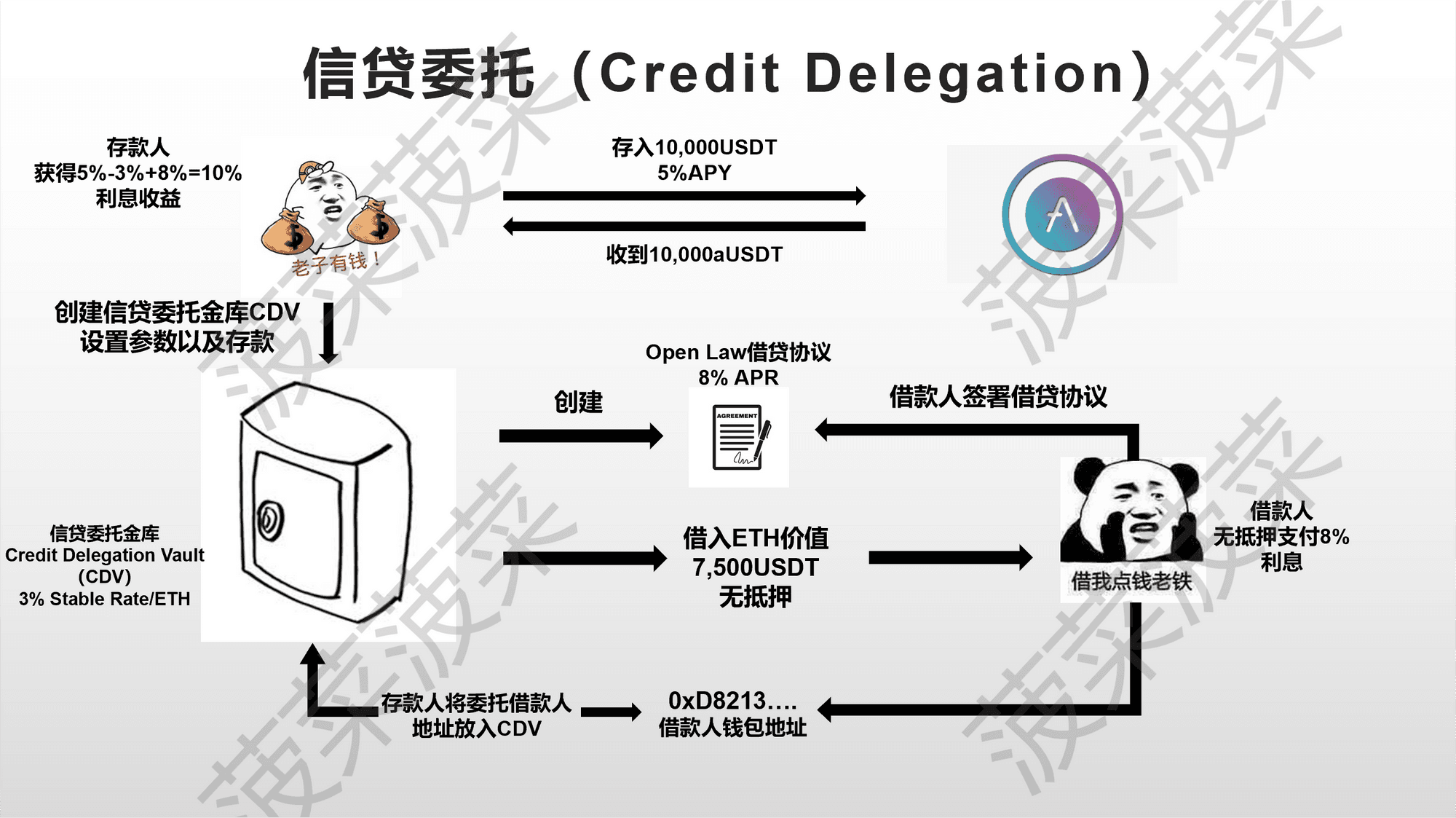

- AAVE users can earn interest income in the credit liquidity protocol and delegate their credit limits to other users to earn additional interest income. This means depositors can use on-chain smart contracts to delegate their borrowing credit limits to one or more borrowers without requiring any collateral, but they must bear the risk of the borrower defaulting.

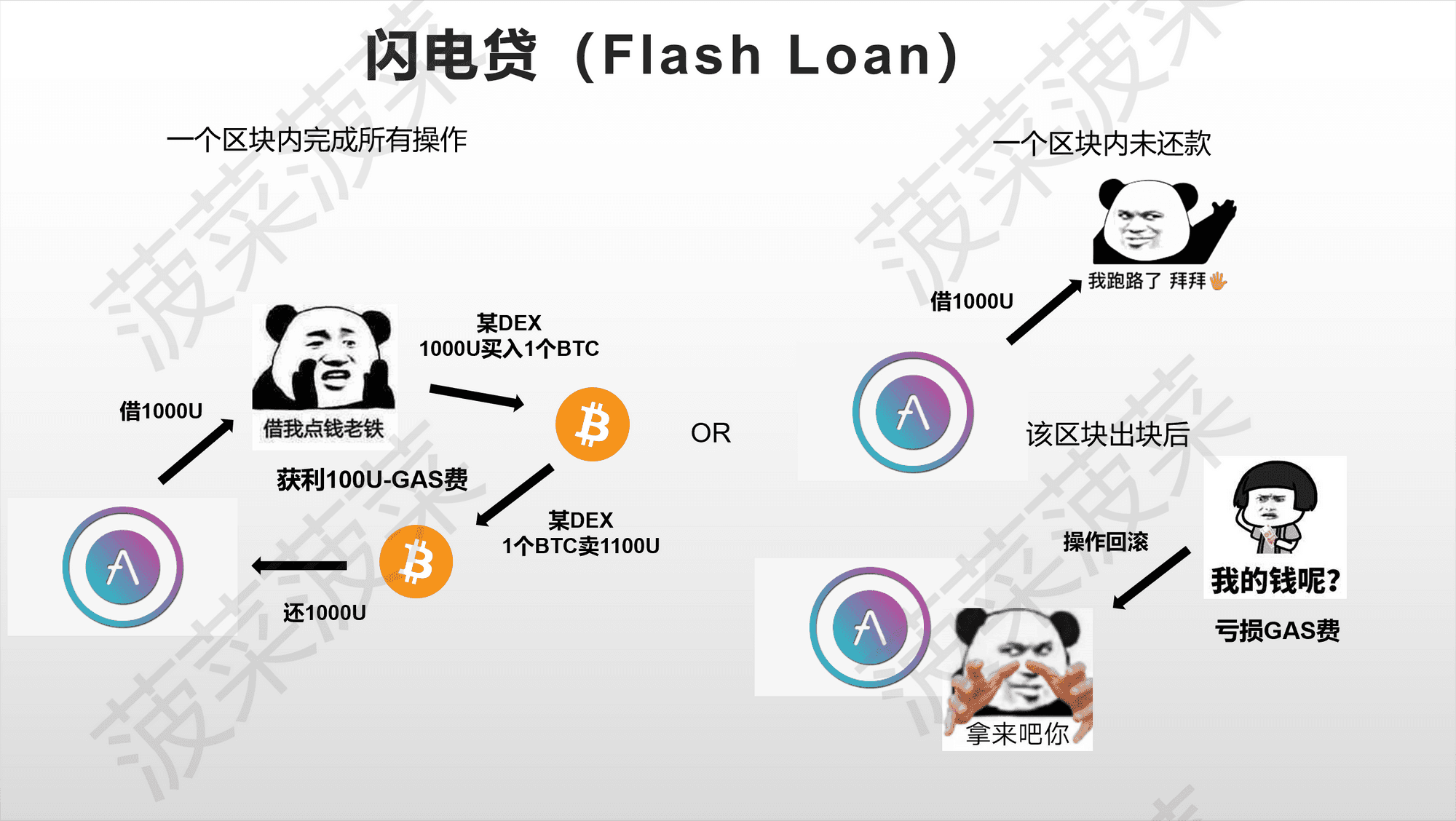

- AAVE was the first protocol in the crypto space to propose the concept of Flash Loans, allowing people to borrow funds without any collateral. However, Flash Loans must be completed within a single block; if the funds are not returned, all operations will be rolled back, and everything will revert to its original state, as if nothing had happened.

- AAVE is the native governance token of AAVE, primarily used for voting governance and staking. The total supply is 16 million, and it has been fully unlocked. The predecessor of the AAVE governance token was ETHLend, issued in 2017 with a total supply of 1.3 billion. When AAVE V1 was launched in 2020, it migrated at a ratio of 1:100, with 3 million AAVE reserved for project ecosystem development.

- The AAVE protocol is operated and managed by AAVE holders in a DAO format, with governance weight determined by the total balance of AAVE and stkAAVE held. Governance token holders have two rights: proposal rights and voting rights. AAVE holders can also sign messages using cold wallets to vote on proposals, and AAVE governance is highly decentralized.

- AAVE holders can directly stake AAVE tokens in the safety module and can also choose to add liquidity combinations of AAVE + ETH in Balancer liquidity pools to obtain ABPT tokens, which can then be staked in the AAVE protocol's safety module for staking rewards and additional BAL rewards and trading fee income. The safety module also provides additional security incentives to encourage more participation in staking activities.

- The AAVE Safety Module protects the protocol from unexpected financial losses during shortfall events. When a shortfall event occurs, the AAVE Safety Module is activated to fill the deficit, with up to 30% of staked assets facing the risk of being used to cover the deficit. Any excess will be compensated by minting additional AAVE.

- Users can generate decentralized stablecoin GHO while earning interest from collateral specified by AAVE governance in the AAVE protocol. When users want to redeem their collateral, they must burn the minted GHO to redeem it. The interest rate for GHO is adjusted through AAVE community governance, and stkAAVE holders participating in the AAVE safety module can enjoy discounted rates for generating GHO.

- The introduction of the decentralized stablecoin GHO can help enhance AAVE's competitiveness in the market and increase user volume and protocol revenue. However, there are risks such as centralization, governance issues, facilitator defaults, and the potential for GHO to be cashed out. Although the minting mechanism is more attractive than DAI, it has yet to be validated by the market.

1. AAVE—The King of DeFi Lending#

(1) What is AAVE?

AAVE is a decentralized, non-custodial liquidity market protocol where depositors (liquidity providers) provide liquidity by depositing assets into AAVE's public pool to earn passive income. Borrowers can freely borrow assets from the pool using various methods, either over-collateralized or uncollateralized.

AAVE's founder, Stani Kulechov, first encountered Ethereum while studying law at the University of Helsinki in Finland and began exploring how Ethereum would impact traditional financial systems. He later founded AAVE in 2017, originally named ETHLend (LEND), and rebranded to AAVE in 2018. The word "AAVE" means "ghost" in Finnish, as AAVE replaces the role of traditional banks by providing a decentralized, transparent, and trustworthy credit platform where neither party knows who lent money to whom, much like a "ghost," which aligns perfectly with the brand meaning of "ghost" in Finnish.

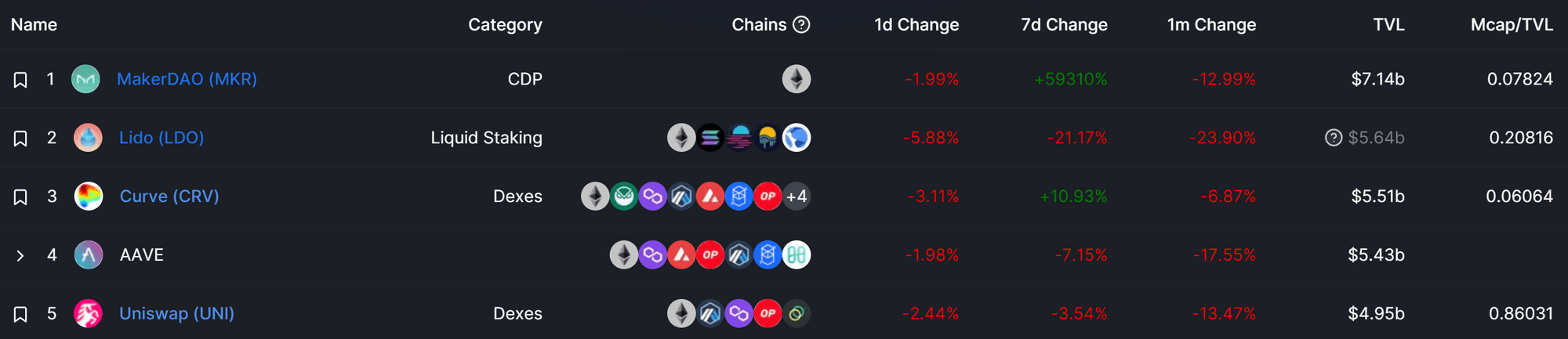

As of September 22, 2022, AAVE ranks fourth in TVL in the DeFi space, surpassing Uniswap. As a lending protocol, AAVE is undoubtedly the king of lending in DeFi.

Data Source: Defillma.com

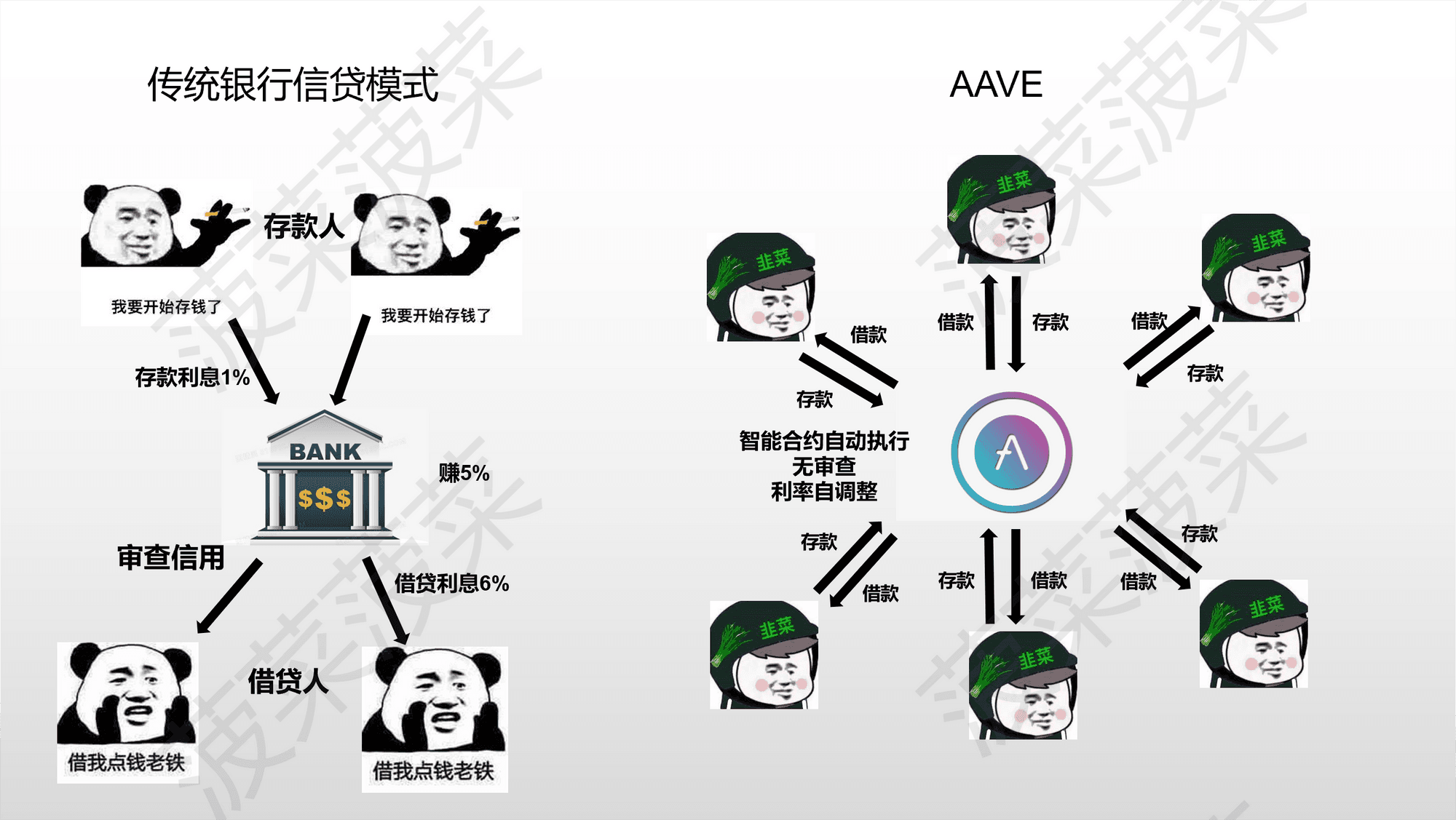

(2) How does AAVE disrupt traditional lending models?

As one of the most frequent economic activities, credit plays a crucial role in the operation of the global economic system. Both individuals and businesses need to borrow to meet certain financial needs. People typically establish credit relationships through centralized financial institutions or directly with individuals or groups. In models that bypass intermediary institutions to establish credit relationships directly with other parties, the trust cost between both parties is very high. Few people would casually trust and lend money to a stranger or lend large sums of money. Although this model may yield higher returns compared to centralized financial institutions, it usually comes with higher risks, such as borrowers defaulting on loans, making it difficult to form large-scale credit.

Most credit relationships are primarily facilitated by centralized financial institutions like banks, which is also one of their main sources of income. Many people deposit idle funds in banks to earn passive income through interest. However, deposits are considered liabilities for banks, as they must pay interest on these deposits. Therefore, banks lend people's deposits to borrowers in need of funds to charge higher interest and profit from the interest rate spread. As intermediaries in credit, banks need to ensure the safety of depositors' funds while also conducting due diligence to ensure borrowers' creditworthiness so that they can repay on time. If a borrower defaults, the bank typically bears the bad debt, as banks have a large pool of funds and stable profits, making depositors' funds relatively safe under certain bad debt rates.

AAVE's disruptive innovation lies in creating a decentralized credit model, using smart contracts to establish a liquidity pool that allows everyone to deposit crypto assets based on market demand to earn passive income and borrow crypto assets from the smart contract while paying interest. It has also innovatively created a Flash Loan model that allows borrowing without any collateral, leveraging the rollback characteristics of blockchain technology. The nature of smart contracts ensures that the set programs will execute according to the code logic and cannot be tampered with. This feature allows AAVE to operate without requiring credit checks on borrowers like traditional banks. Additionally, smart contracts automatically adjust interest rates based on supply and demand and implement efficient liquidation processes to ensure the operation of the entire credit model. Unlike traditional financial institutions, borrowing on AAVE can continue indefinitely as long as it does not face liquidation, whereas borrowing from traditional banks often comes with repayment deadlines.

In simple terms, traditional finance has entry barriers for credit activities, requiring credit checks on borrowers, and the larger the loan amount, the longer the processing time. Banks often have low efficiency in collateral liquidation, and negligence in credit checks can lead to bad debts. For example, during the 2008 U.S. subprime mortgage crisis, traditional banks faced human factor risks, as they relaxed credit checks on borrowers to earn more profits, laying the groundwork for future defaults. Furthermore, the value of collateral is updated slowly, only reassessed during re-evaluations, which may occur every two to three years for short-term loans, while mortgages may not be re-evaluated for a long time after the contract is signed (updating annually is unrealistic).

Finally, the liquidation cycle is long, involving legal processes such as lawsuits, seizures, and auctions that can take years, especially during the backlog of cases in 2008. While housing prices were rapidly declining, the slow auction process exacerbated the situation. By the time liquidation was completed, the auction proceeds often fell short of covering the previous losses, resulting in bad debts. In contrast, AAVE's liquidation mechanism relies on timely price updates from oracle systems, enabling rapid on-chain liquidations through smart contracts. The high efficiency of liquidation significantly reduces the likelihood of bad debts on AAVE compared to traditional finance. Even in the event of a black swan event leading to bad debts, the protocol's safety module protects the protocol and the funds of liquidity providers.

(3) How to profit from AAVE?

Whether in the real world or the crypto world, people have a demand for credit functions. For depositors, AAVE can meet the needs of long-term holders who wish to generate additional income. For borrowers, AAVE can provide the funds needed for trading activities such as arbitrage, leverage, and market making, as well as short-term liquidity needs. To use AAVE's functions, users first need to deposit assets into AAVE's liquidity protocol smart contract. Once assets are deposited, users receive the aToken version of the deposited assets, such as aUSDT for USDT deposits. The aToken serves to calculate interest, allowing users to earn interest income while also using it as collateral to borrow other assets.

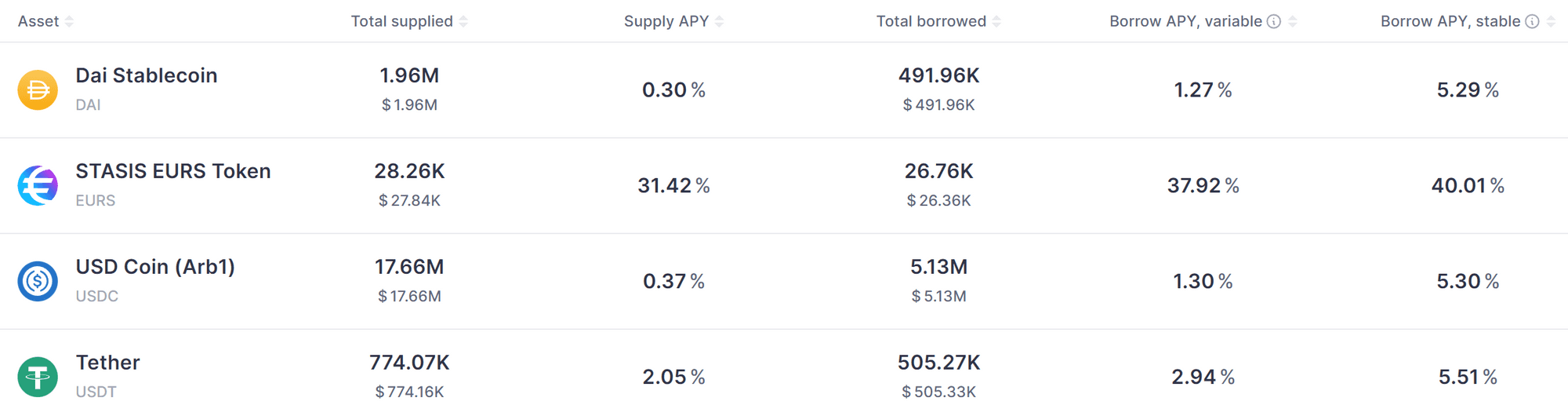

For most users looking to profit from AAVE, arbitrage and leverage are the most common strategies. For example, if user A holds 10,000 USDT and wants to hedge and hold long, depositing USDT into AAVE is a good option. If user A wants to maximize returns, they can deposit 10,000 USDT and use it as collateral to borrow 7,500 DAI (a relatively safe ratio), then convert the DAI back to USDT and deposit it into the USDT deposit contract. This way, user A has completed arbitrage and leverage between stablecoins, as borrowing DAI incurs only 1.27% interest while depositing USDT yields 2.05%. The risk of price decoupling between stablecoins is minimal, making this strategy low-risk and increasing returns.

This is just one of the ways to play on AAVE. Users can also seek interest rate differentials or price discrepancies across different DeFi platforms using Flash Loans for arbitrage, leveraging their volatile assets to amplify returns, and more.

2. What functions and mechanisms does AAVE have?#

(1) How does AAVE's interest rate model change according to market demand?

AAVE's interest rate model allows deposit and borrowing interest rates to change with market supply and demand. When more people borrow, deposit rates and loan interest rates rise to encourage deposits and reduce borrowing. Conversely, when fewer people borrow, deposit and loan interest rates fall to encourage borrowing.

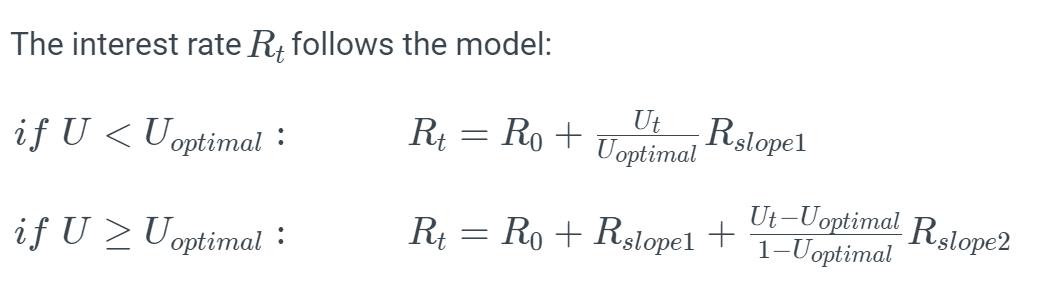

The most critical indicator determining these changes is the utilization rate U, which indicates how much of the liquidity pool's funds have been borrowed. When more people borrow, causing the utilization rate to reach a critical point, the borrowing interest rates and deposit rates will begin to rise exponentially. High profits and expensive interest rates will attract more people to deposit and repay, effectively avoiding liquidity issues that could prevent depositors from withdrawing their assets.

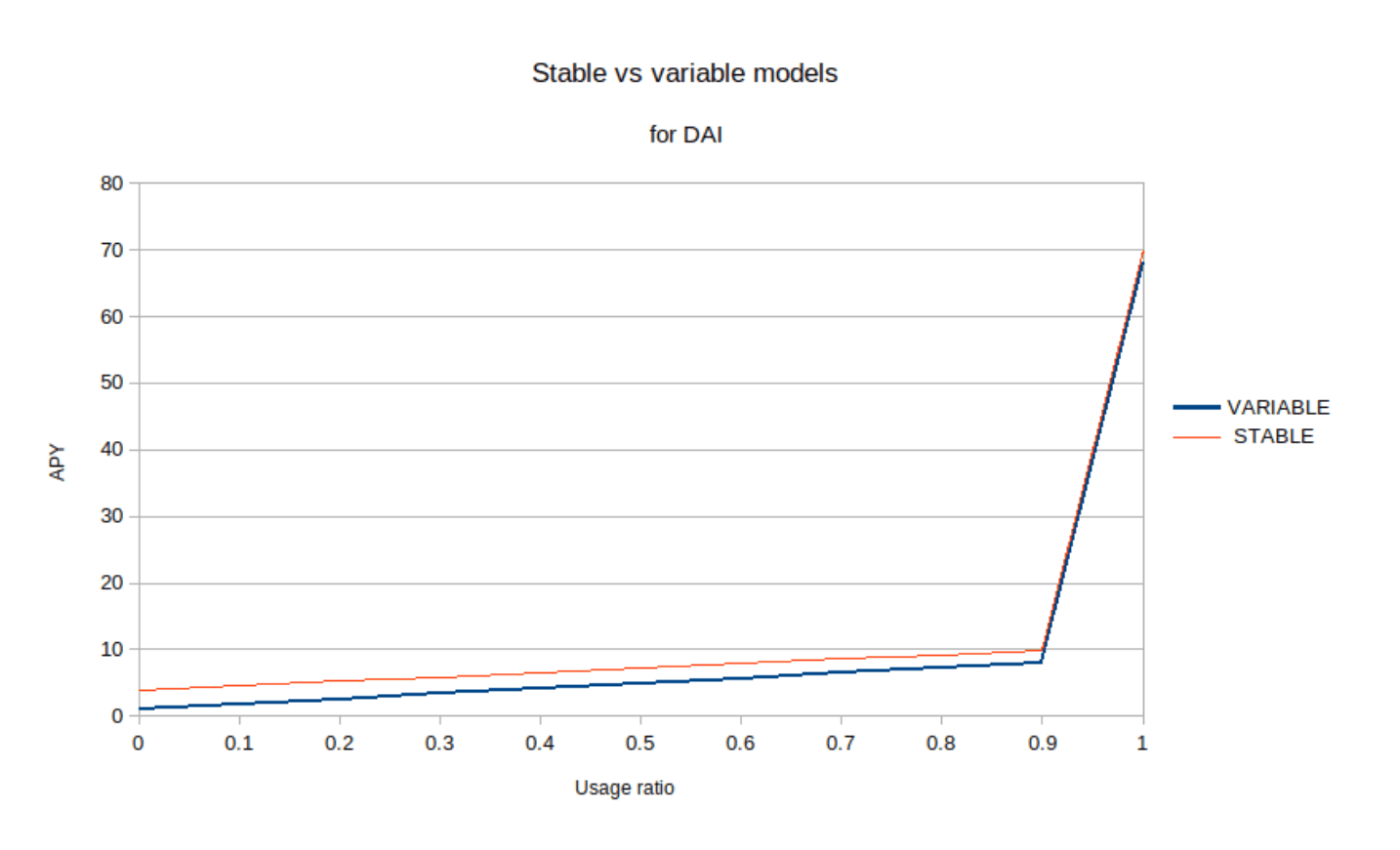

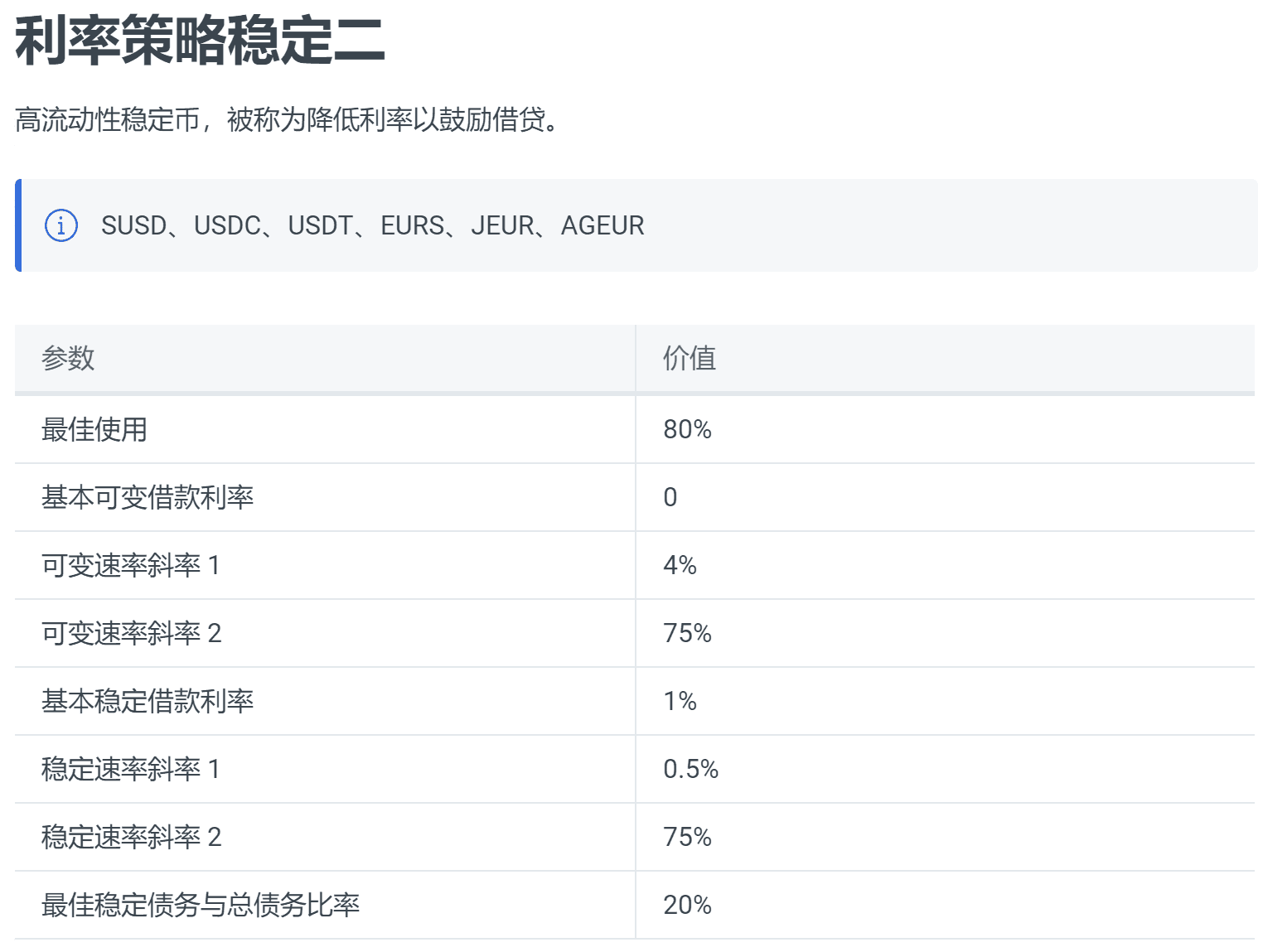

Users can choose between two interest rate models when borrowing: variable rates and fixed rates. Variable rates are suitable for short-term borrowing, while fixed rates are suitable for long-term borrowing and for users who prefer predictability. The official interest rate model formula shows that when the utilization rate U is less than the optimal utilization rate Uoptimal, the interest rate changes follow the Rslope1 slope. However, when the utilization rate U exceeds the optimal utilization rate Uoptimal, an additional Rslope2 slope is introduced, which is typically very high, causing interest rates to grow exponentially.

However, fixed rates are not always fixed. In the latest update of the official interest rate model, the interest rate strategy for DAI is that when the utilization rate reaches 90%, the interest rate will grow exponentially. The fixed rate will not be reset until the utilization rate reaches 95%, but if the utilization rate exceeds 95%, the fixed rate will be reset to address liquidity shortages (as referenced from the source article below).

Image Source: https://medium.com/aave/aave-borrowing-rates-upgraded-f6c8b27973a7

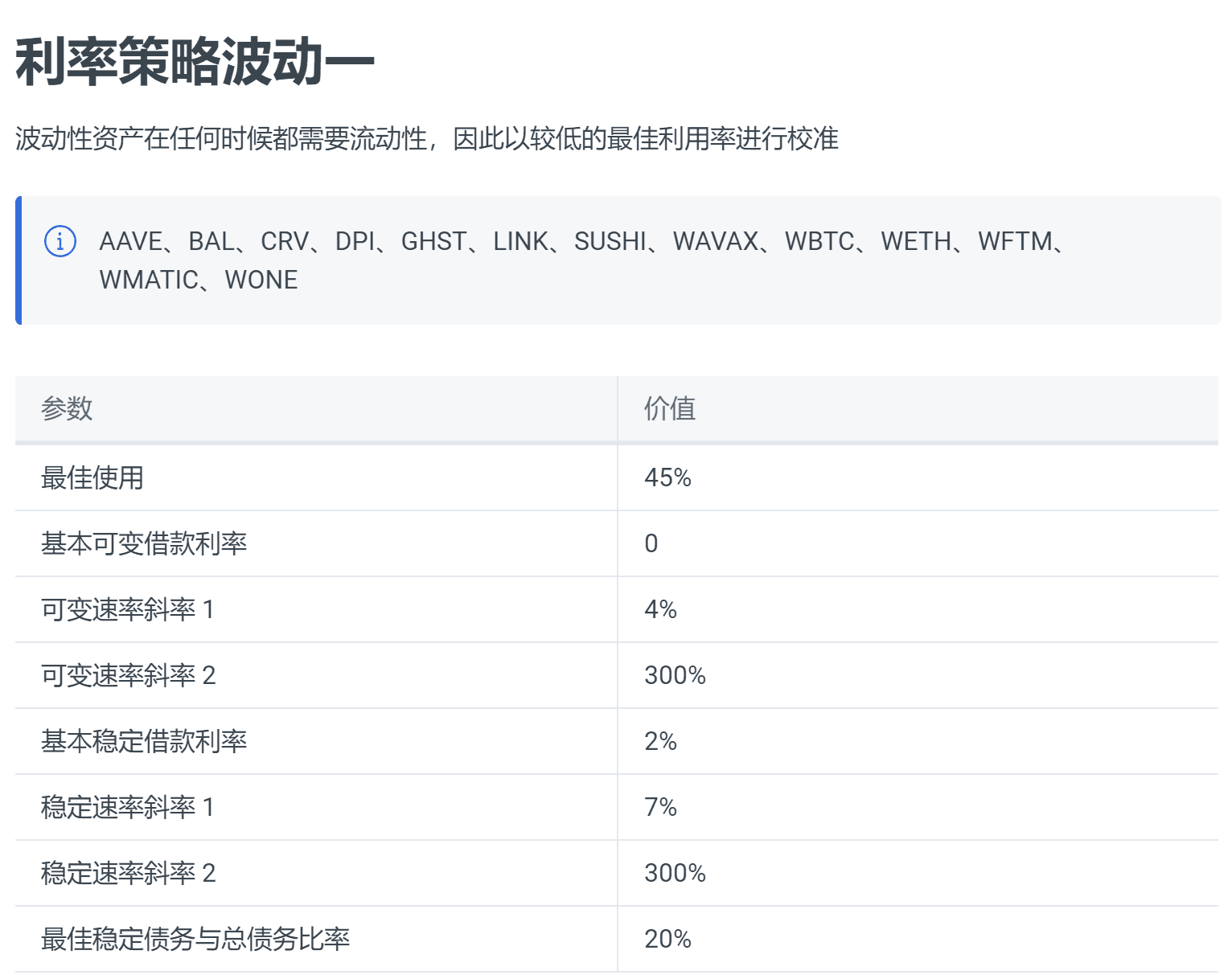

AAVE has three different interest rate model strategies. The first strategy is primarily for volatile assets, where liquidity demand is crucial at all times. Therefore, the optimal utilization rate for volatile assets is 45%. When 45% of the assets in the liquidity pool are borrowed, the deposit and loan interest rates will increase using a very high slope of 300% (Rslope2).

Data Source: https://docs.aave.com/risk/liquidity-risk/borrow-interest-rate

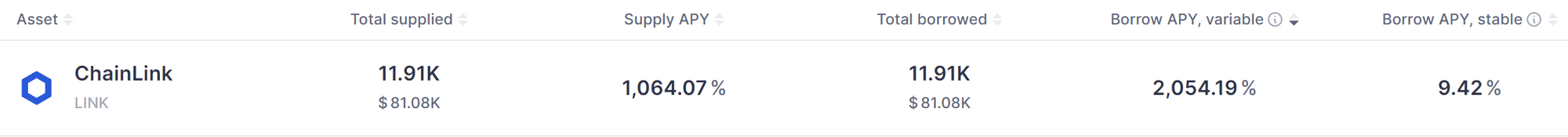

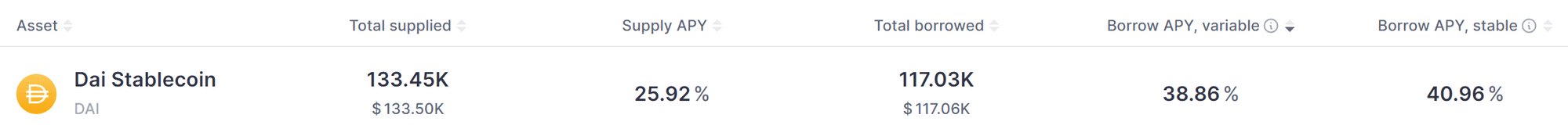

Case Study: On the Harmony chain, due to cross-chain bridge issues, the ChainLink liquidity pool was completely borrowed out (reason unknown). At this point, we can observe that the interest rate changes are significant, with the yield for depositing ChainLink at 1064% and the interest for borrowing ChainLink at 2054%. This demonstrates that when the utilization rate of volatile assets exceeds the optimal rate, the interest rate increases dramatically.

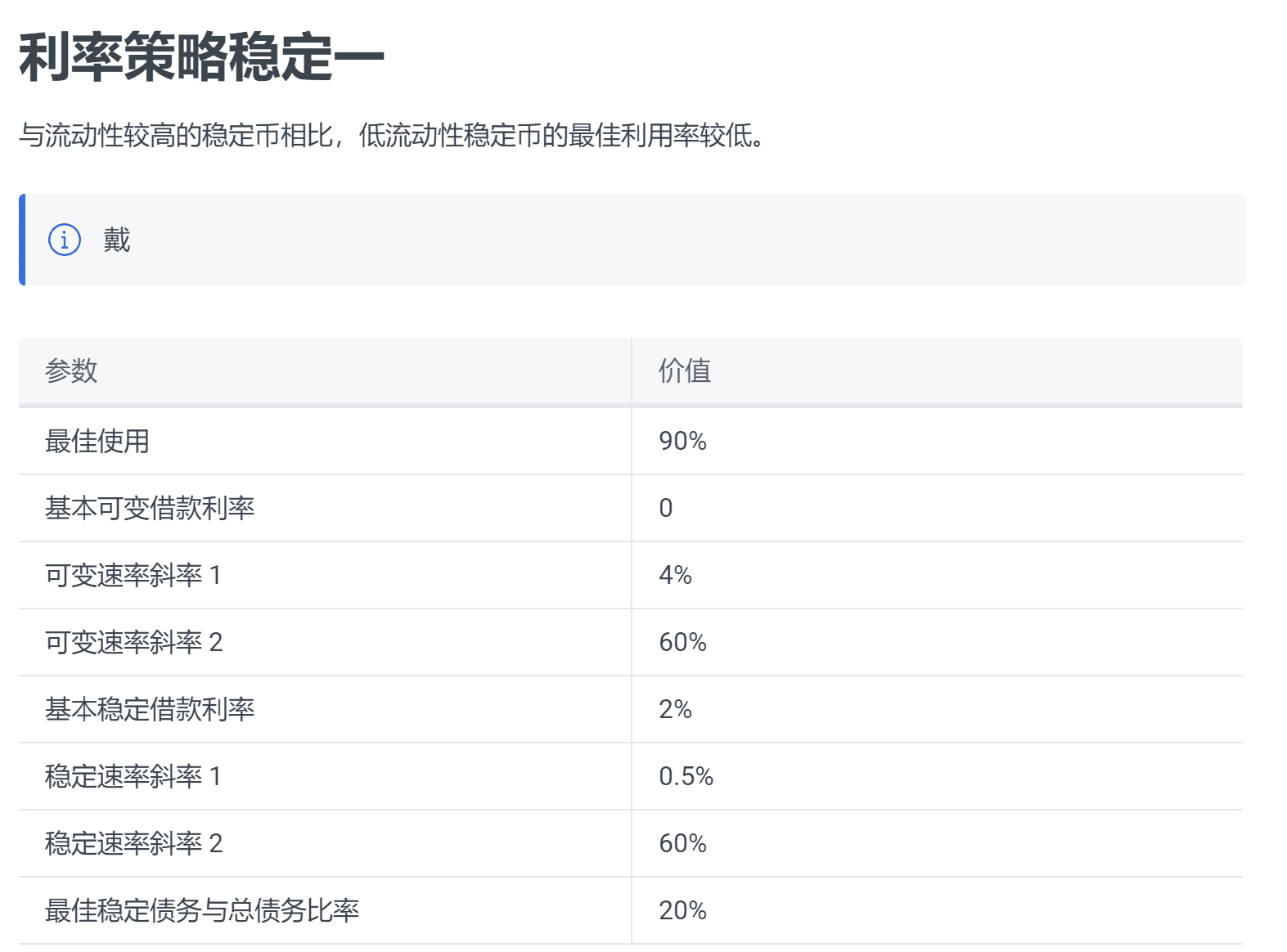

The second and third strategies are aimed at stablecoins, with slightly different optimal utilization rates. Since stablecoins are pegged to fiat currencies and have very low volatility, the optimal utilization rate for stablecoins is much higher, and the slope Rslope2 when exceeding the optimal utilization rate is also significantly lower than that of volatile assets.

Data Source: https://docs.aave.com/risk/liquidity-risk/borrow-interest-rate

Case Study: When stablecoins are borrowed beyond the optimal utilization rate, the interest rate growth is noticeably lower than that of volatile assets. However, high-interest stablecoins can attract more deposits and repayments compared to volatile assets, so liquidity issues are rarely a concern.

(2) How does AAVE conduct liquidations?

In traditional finance, the liquidation process involves legal procedures. For example, if someone borrows 10 million from a bank to purchase property but ultimately cannot repay the loan, the bank will apply for an auction of the property through legal means to recover the loan amount of 10 million plus interest. Once the court accepts the case, it charges a fee and lists the property for auction. If the auction price is 8 million, the borrower still owes the bank 2 million, resulting in a 2 million bad debt for the bank, which continues to pursue the borrower for repayment. The liquidation process in the real world typically involves legal procedures, making it time-consuming and inefficient. In the crypto world, however, the existence of smart contracts allows for highly efficient liquidations.

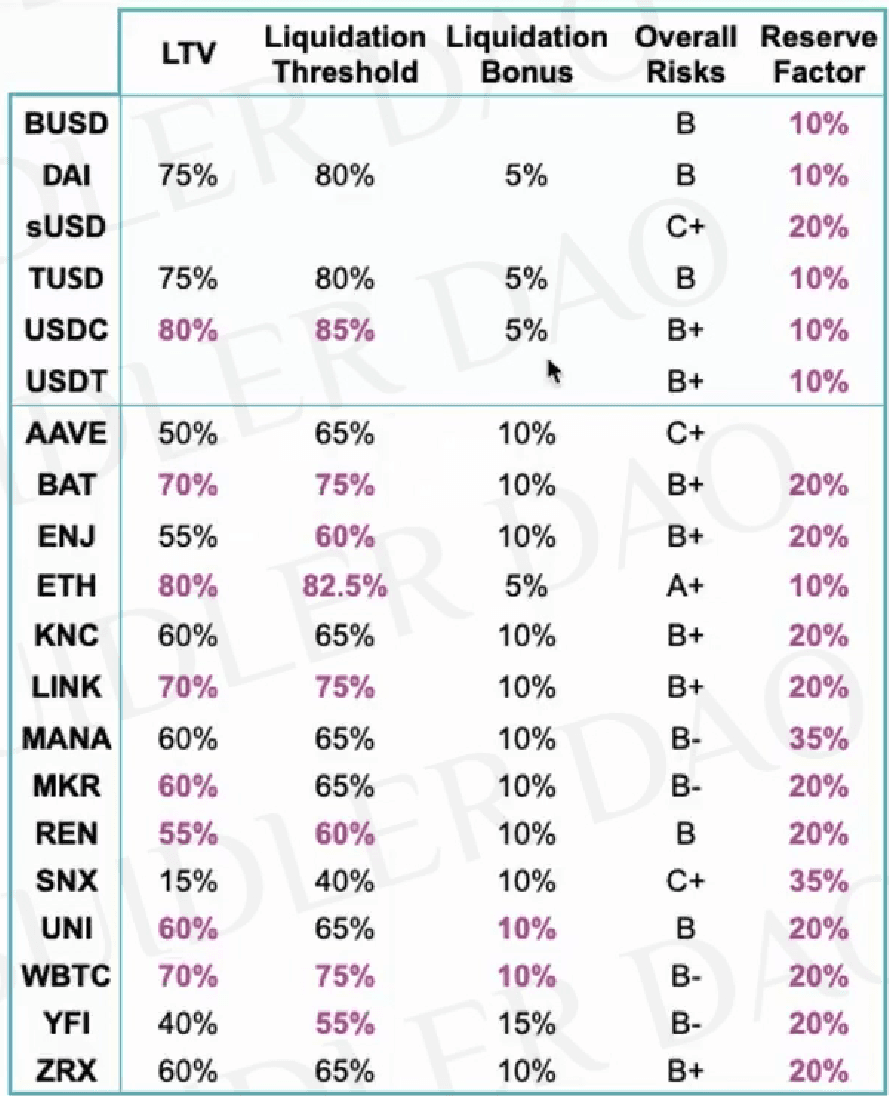

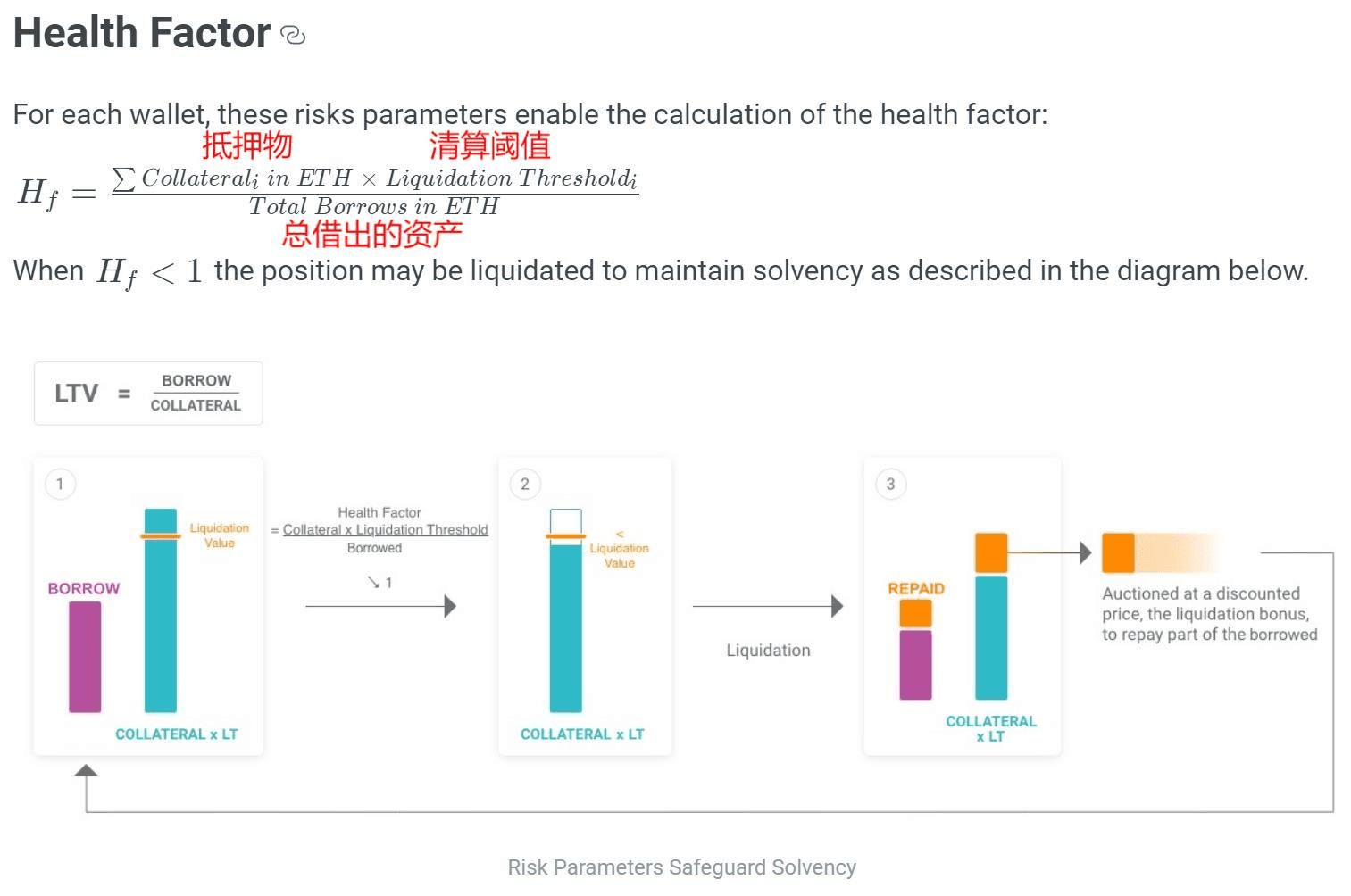

In AAVE, the Loan-to-Value (LTV) ratio represents the maximum asset ratio that can be borrowed against specific collateral. For example, with an LTV of 80%, for every 1 ETH of collateral, only 0.8 ETH can be borrowed. The LTV typically changes with market conditions, and the liquidation threshold is the percentage at which the collateral is insufficient. When the collateral-to-loan ratio reaches the liquidation threshold, it faces liquidation. Each token has different LTVs and liquidation thresholds. When a user faces liquidation, they must pay a certain percentage of the liquidation bonus to the liquidator as a liquidation fee.

Image Source: https://www.bilibili.com/video/BV1R3411c7Ys/?spm_id_from=333.788&vd_source=1ed71a6384124a58acb2ed606c7db6c0

A key indicator for determining whether a user is facing liquidation is the health factor, which is the ratio of the value of borrowed assets to the value of collateral assets. It can be calculated as collateral × liquidation threshold ÷ total borrowed assets. When the health factor is less than 1, the AAVE protocol faces bad debt, and the user enters the liquidation process.

Image Source: AAVE Official Documentation

The smart contracts of the AAVE protocol cannot automatically perform liquidation operations, so AAVE's liquidation process requires third parties to complete it. Liquidators must call AAVE's liquidation smart contract to obtain information about accounts facing liquidation and execute the liquidation operation. The liquidated party must pay an additional liquidation penalty to incentivize more people to participate in liquidations.

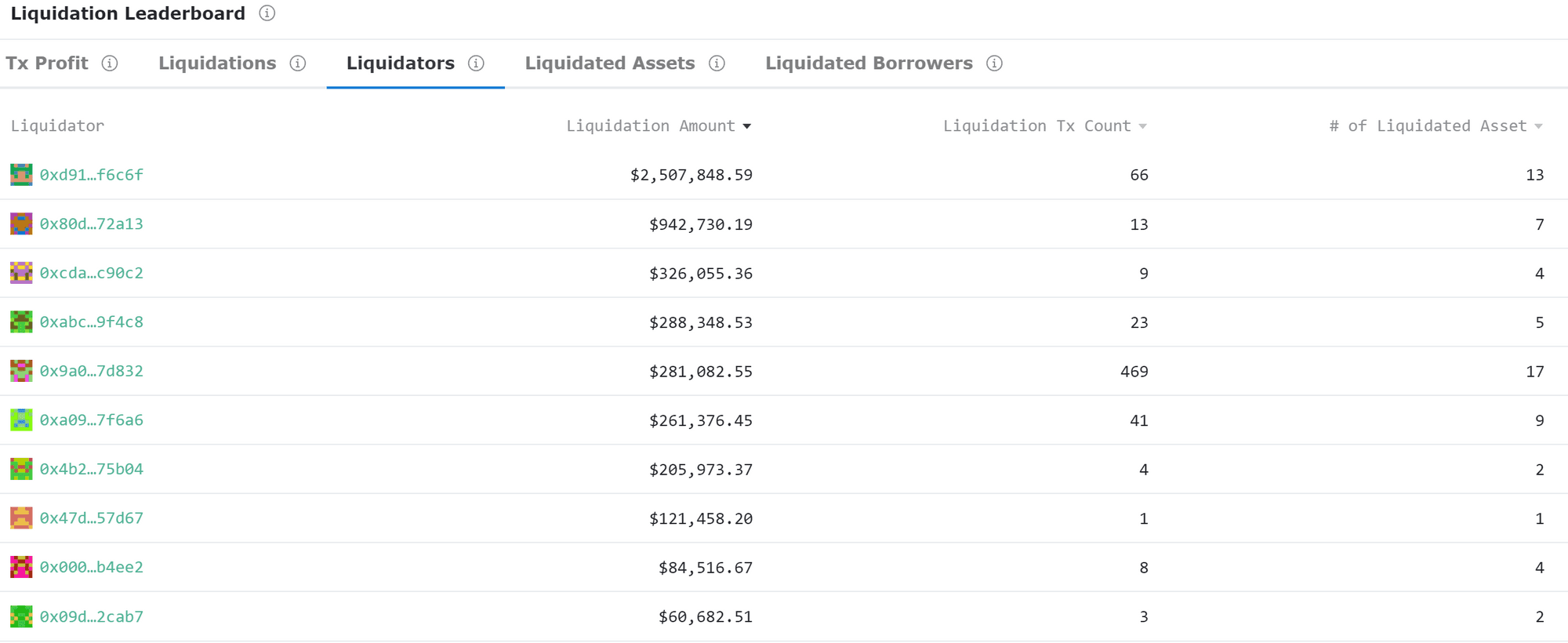

Although anyone can call the liquidation contract to act as a liquidator, the current threshold for liquidators is very high, usually executed by professional liquidation bots that require substantial capital, making it nearly impossible for ordinary individuals to participate. Moreover, leading liquidation bots have a significant advantage, as we can observe that the top-ranked liquidator in recent times has participated in liquidations with amounts greater than the total amounts of all other liquidators combined.

Data Source: https://eigenphi.io/ethereum/liquidation

(3) What is the Credit Delegation mechanism?

AAVE users can earn interest income in the credit liquidity protocol and can also delegate their credit limits to other users to earn additional interest income. This means depositors can use on-chain smart contracts to delegate their borrowing credit limits to one or more borrowers without requiring any collateral. Borrowers can directly borrow funds within the credit limit specified in the smart contract and return them directly in the smart contract.

This collateral-free model requires a high level of trust from borrowers, and depositors must bear the risk of borrowers defaulting. Therefore, this credit delegation is typically used in credit relationships between acquaintances or between institutions. The specific process is as follows:

(4) What is a Flash Loan?

AAVE is the first protocol in the crypto space to propose the concept of Flash Loans. Why is Flash Loan considered the coolest feature of AAVE? Because Flash Loans create a loan model that has never existed before, allowing borrowing without any collateral while ensuring that funds will be returned.

The principle of Flash Loans is to complete a transaction that includes borrowing and repaying within a single block to achieve collateral-free loans. Due to the nature of blockchain, a block only becomes a "fact" once it is packaged. When users use Flash Loans, they must complete a transaction that includes borrowing, trading operations, and repayment within a single block for it to be considered successful. If any part of the process fails, the entire transaction cannot be completed.

For example, if a user borrows funds using a Flash Loan but does not perform the repayment operation, the funds will automatically roll back to their original state, as if nothing had happened. This is because the operation is considered a failed transaction within a single block and cannot become a "fact." Flash Loans are commonly used for arbitrage and only require payment of one GAS fee and the Flash Loan protocol fee. If there are good arbitrage opportunities, the profits from Flash Loans can be unlimited. However, since Flash Loans must be completed within a single block, manual operations cannot achieve Flash Loans; they require code to execute, making the entry threshold relatively high.

3. What is the AAVE Token? What can it be used for?#

(1) AAVE Economic Model

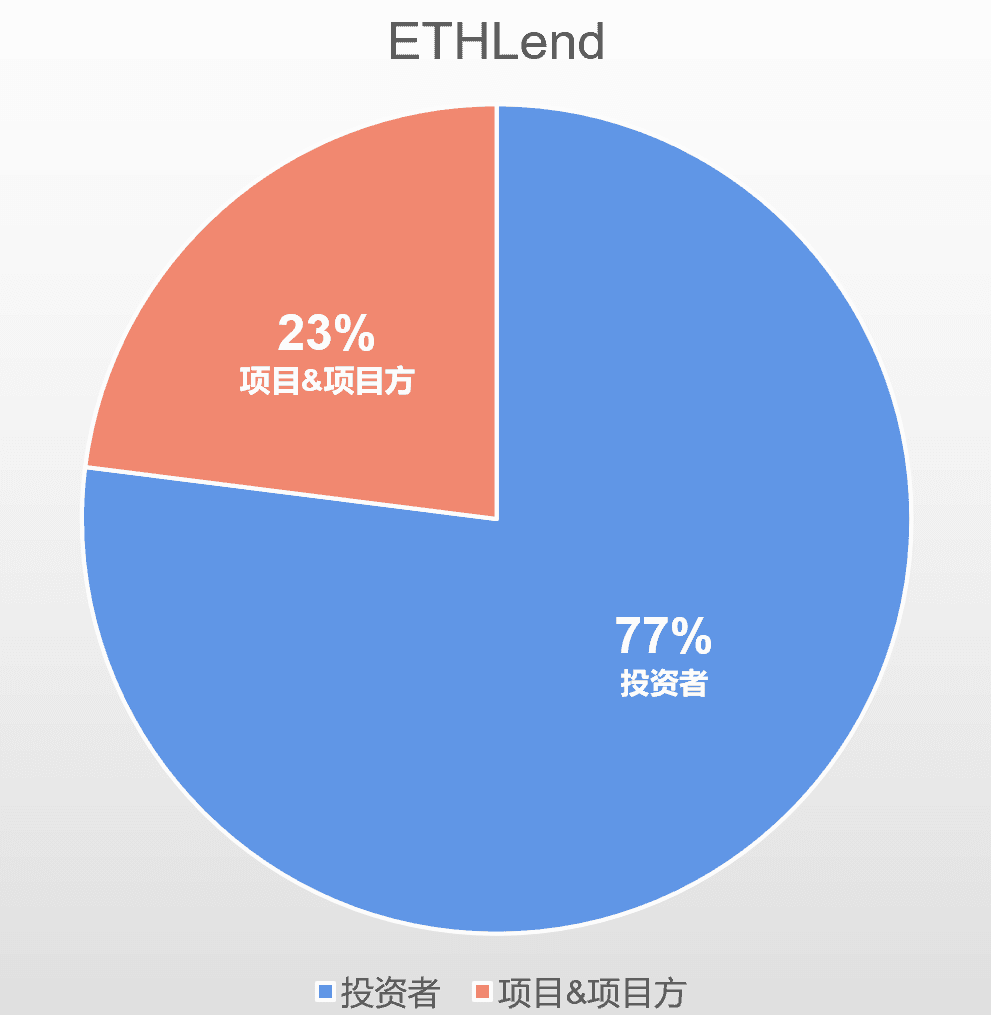

AAVE is the native governance token of AAVE, primarily used for voting governance and staking. The total supply is 16 million, and it has been fully unlocked. The predecessor of the AAVE governance token was ETHLend, issued in 2017 with a total supply of 1.3 billion. When AAVE V1 was launched in 2020, it migrated at a ratio of 1:100, with 3 million AAVE reserved for project ecosystem development. Initially, when ETHLend was issued, 77% was distributed to investors, while the project and project team held only 23%. Although it was initially issued and operated in a centralized manner, after several years of development, AAVE has moved towards true decentralization.

Data Reference: https://tokenomicsdao.substack.com/p/tokenomics-101-aave

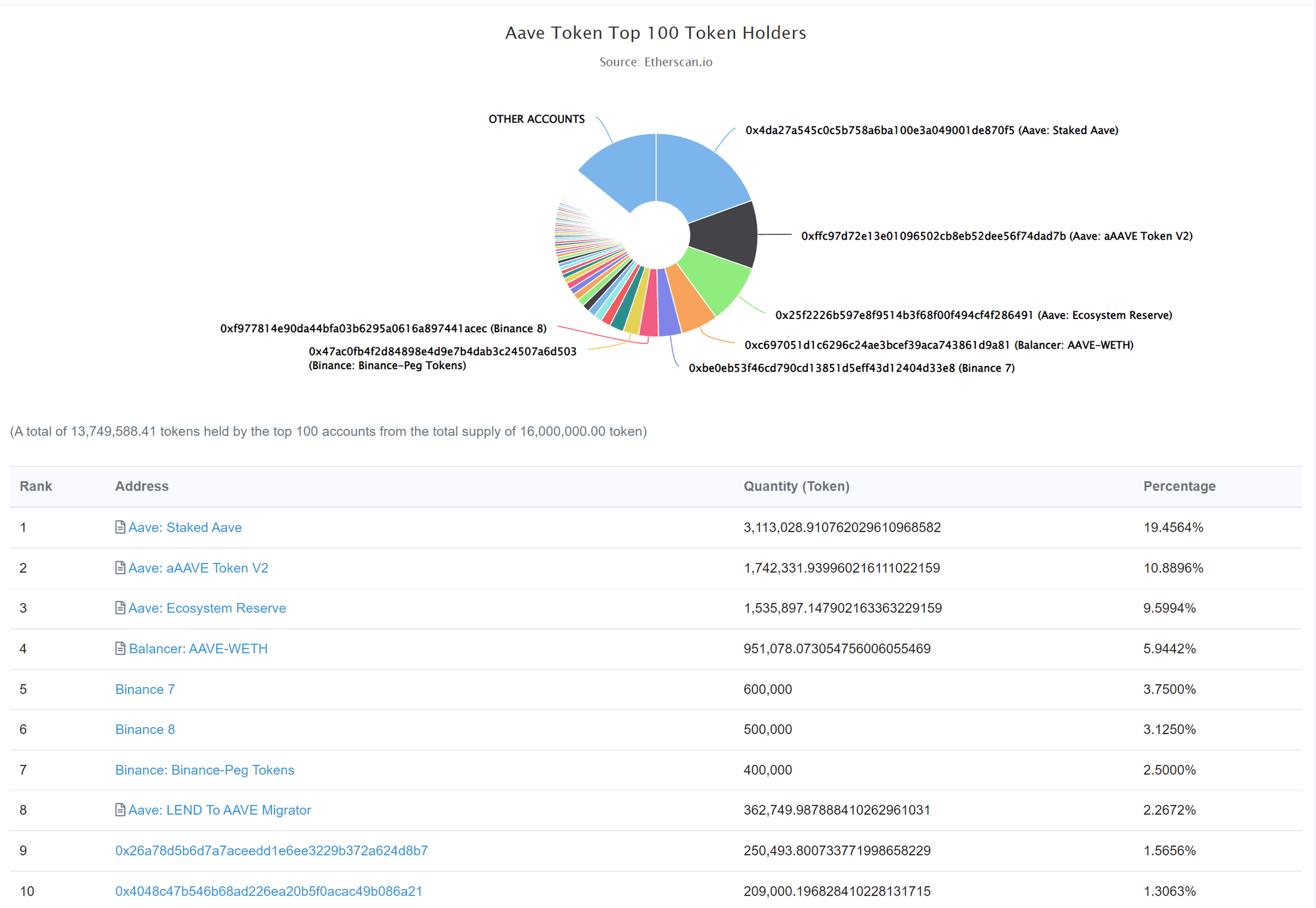

Most crypto projects often reserve a large proportion of tokens for themselves or have overly centralized token holdings. However, AAVE demonstrates its decentralized nature well. In the current distribution of AAVE tokens, no centralized entity, individual, or team holds a significant amount of tokens. The project's smart contracts hold the majority of the share, and even Binance, the largest holder, only holds about 10% of the total share. The individual with the most tokens holds only 1.56% of the total share, with most tokens held by many individuals.

Data Source: https://etherscan.io/token/tokenholderchart/0x7Fc66500c84A76Ad7e9c93437bFc5Ac33E2DDaE9

(2) What can Aave Token be used for?

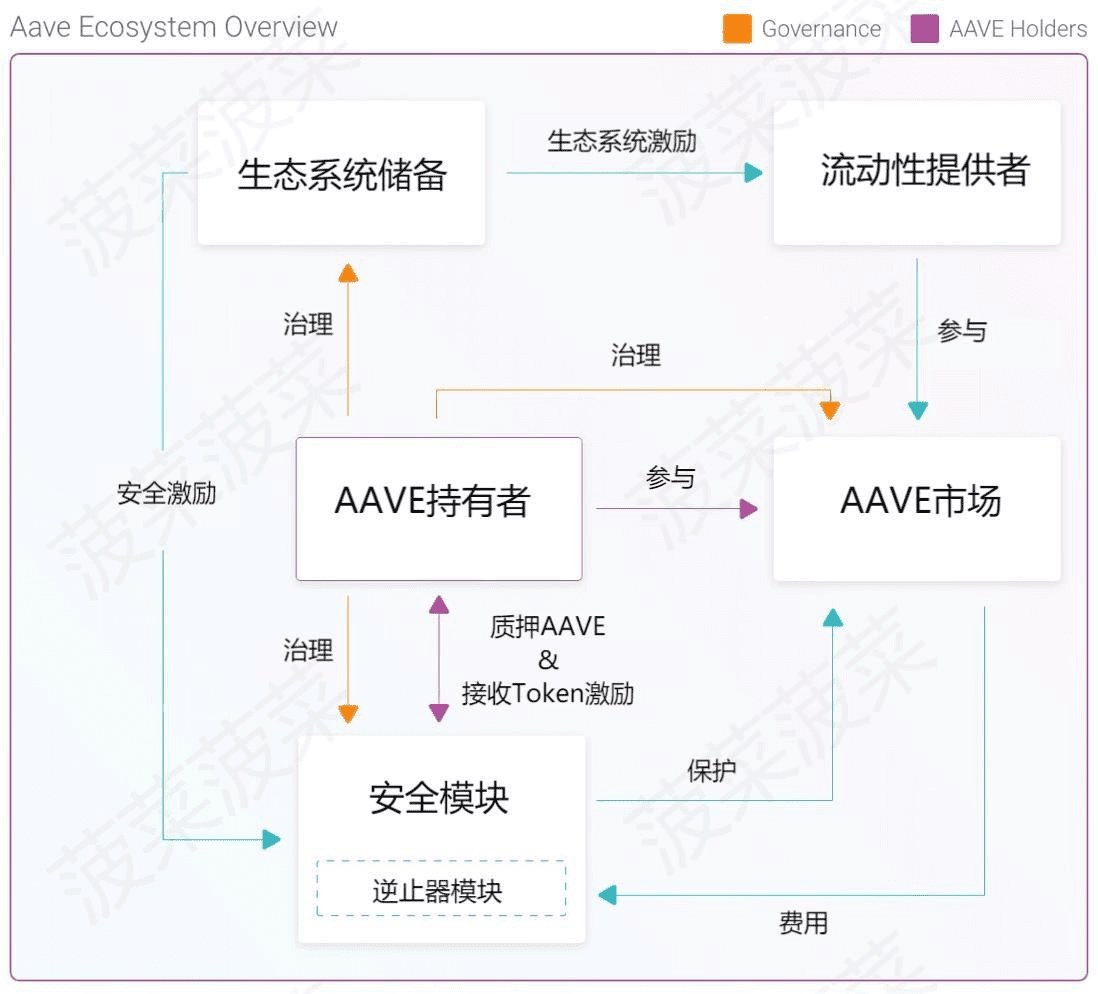

In the entire AAVE ecosystem, the two most important functions of the AAVE Token are to participate in the governance of the AAVE protocol and to stake in the safety module to earn AAVE protocol profit distributions.

Governance

The AAVE protocol is operated and managed by AAVE holders in a DAO format, with governance weight determined by the total balance of AAVE and stkAAVE held. Governance token holders have two rights: proposal rights and voting rights. Token holders can create proposals and vote for or against proposals, which typically include:

- Changes to AAVE market risk parameters

- Incentive parameters for ecosystem reserve funds

- Allocation of treasury funds

- Addition, suspension, or removal of assets

- Adjustments to protocol mechanisms

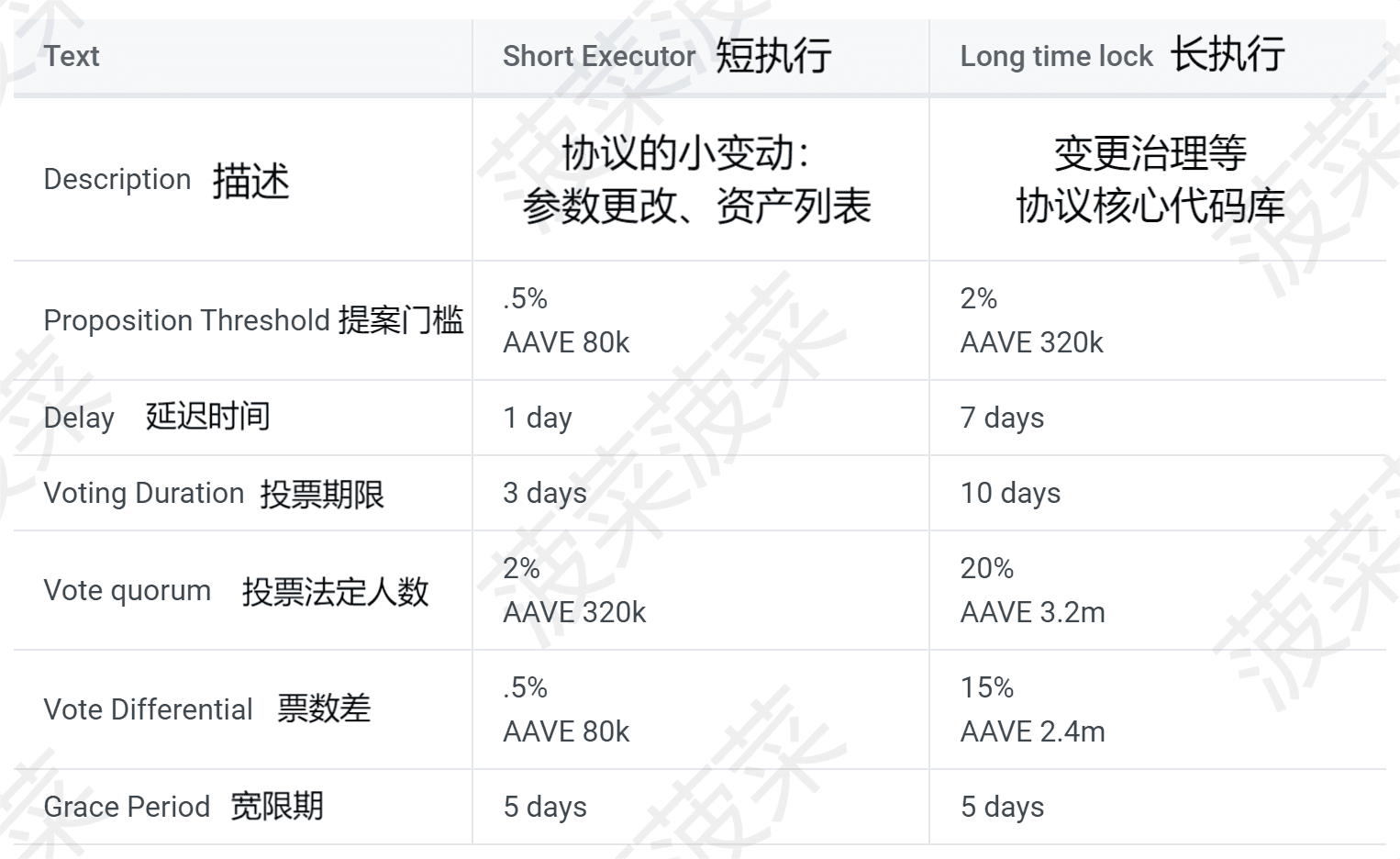

Proposals are usually divided into two types: short execution (Short Executor) and long execution (Long time lock). Short execution typically involves changes to protocol parameters, asset listings, etc., while long execution proposals involve changes to core codebases, with different time and voting requirements for each.

Data Source: Official Documentation

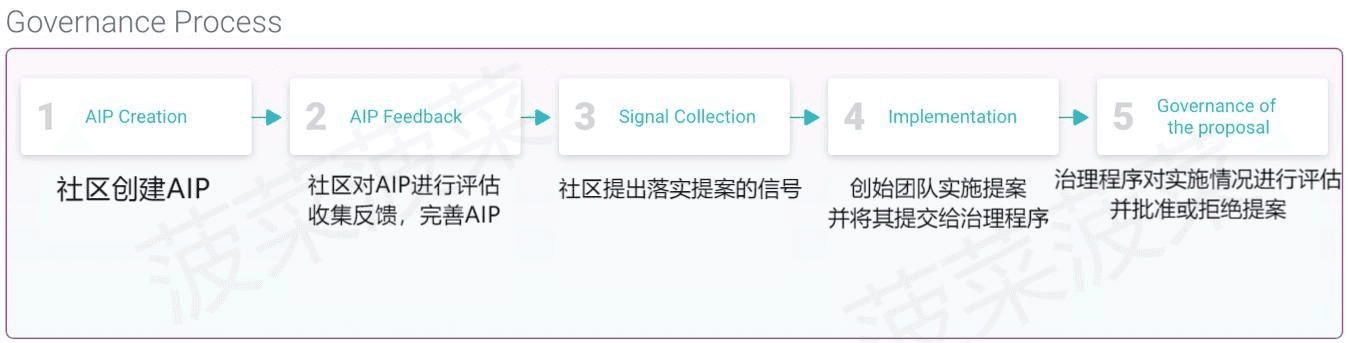

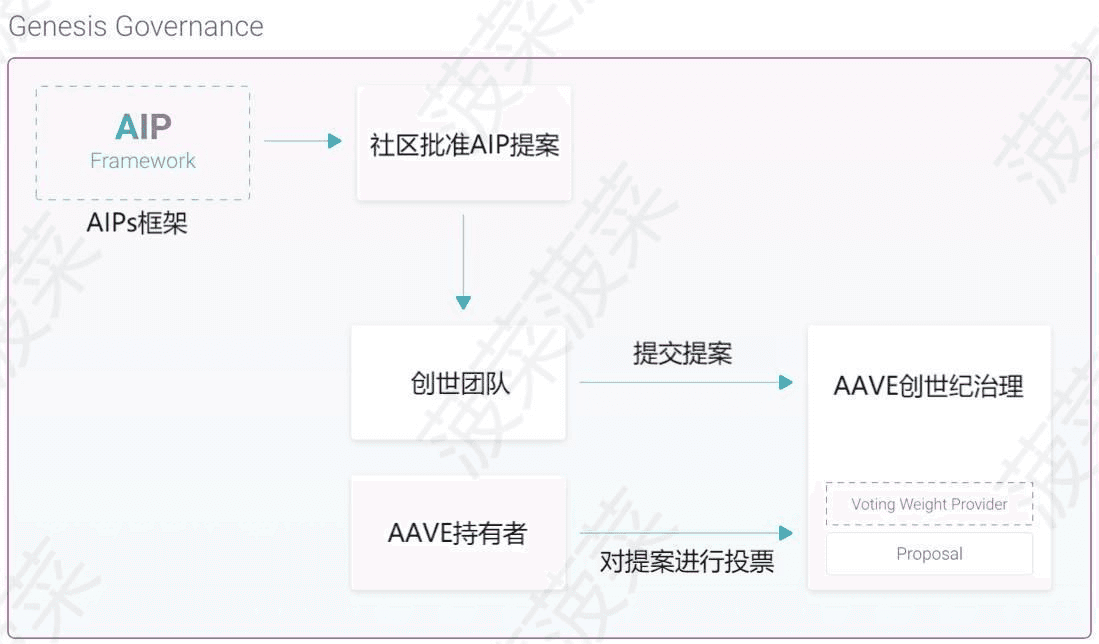

When someone wants to propose a change, they typically need to gather feedback from the community to gain initial support. After obtaining community support, the Genesis Team submits the proposal to the Genesis Governance process.

Genesis Governance is a governance contract that uses AAVE as the sole voting asset. Its core components include:

- AaveProtoGovernance: The core component of governance that stores the state related to each submitted proposal, allowing governance token holders to vote and enabling the execution of approved proposals. This contract will have the ownership required to execute proposals that include all guiding operations of the Aave ecosystem.

- AssetVotingWeightProvider: Defines the weight of voters when voting on proposals. Only governance tokens are allowed to vote, with a weight of 1 (1 Token = 1 vote).

Once a proposal is submitted to the governance contract, AAVE holders can vote on it. Unlike governance systems of other protocols, AAVE allows users to vote using cold wallets. Users only need to sign messages with their cold wallets and forward them using different wallets to vote, making it more convenient for users holding large amounts of AAVE in cold wallets to participate in governance without withdrawing their assets. The only requirement is that the AAVE representing voting weight must be stored in the cold wallet that signs the message during the proposal period.

This method has a flaw: since it does not require locking tokens and only needs message signing, users can use the same tokens across multiple wallets to vote multiple times. To avoid this situation, the governance process includes a voting challenge procedure to verify the authenticity of votes, which can be activated under the following conditions:

- The minimum voting duration is reached, and the number of voters exceeds the quorum.

- The minimum duration has not been reached, but the votes have exceeded the quorum. In this case, a manual trigger is needed to initiate the challenge period.

During the verification period, each address participating in the vote will be queried, and any address that does not hold voting tokens will have its voting rights canceled. If the proposal threshold is exceeded as a result, the voting period will restart.

Unlike MakerDAO's "oligarchic governance," AAVE's governance achieves true decentralized governance. Users do not need to stake and lock AAVE to have governance rights, and the distribution of AAVE ensures that no individual or group can use their governance weight to decide any proposal.

Staking

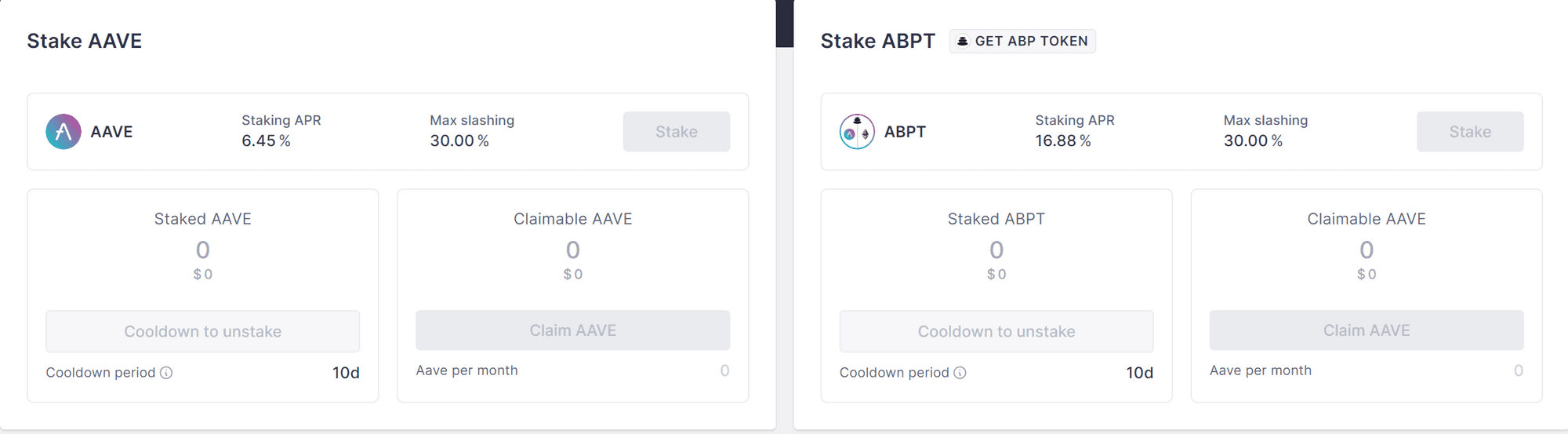

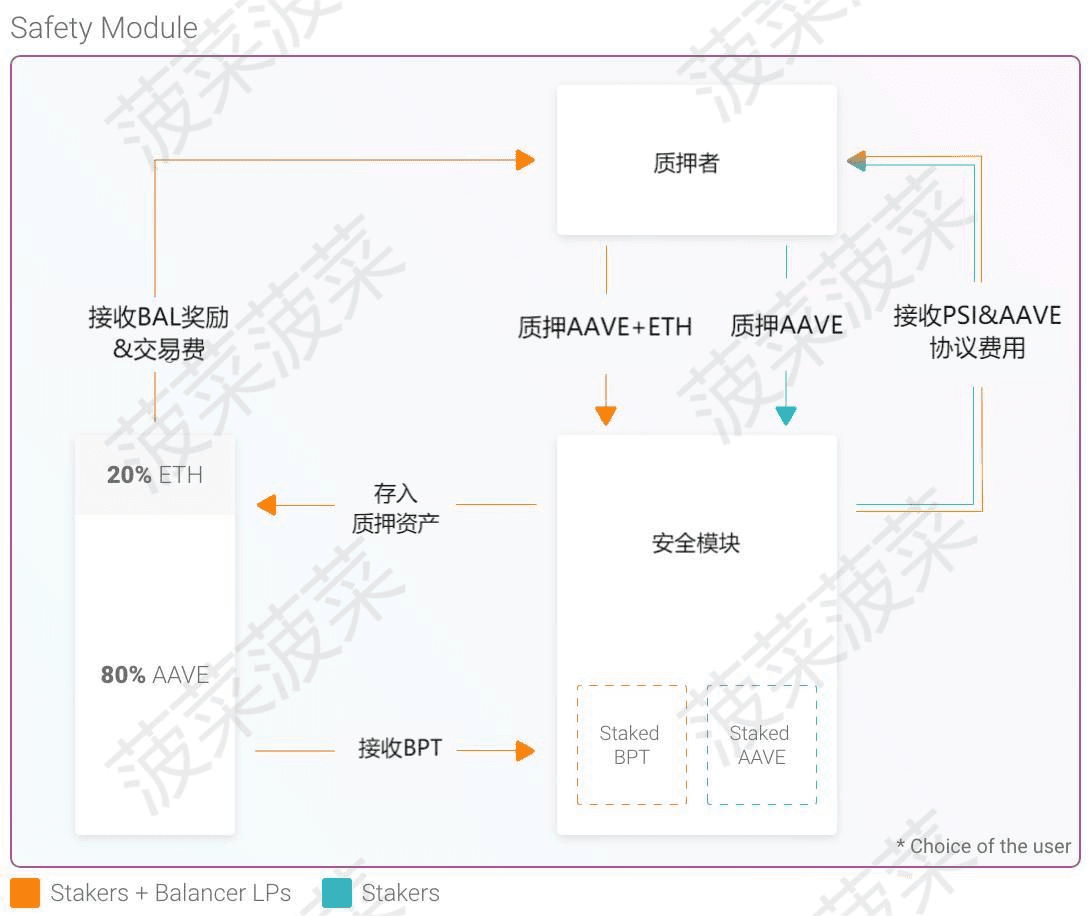

AAVE holders can directly stake AAVE tokens in the safety module and can also choose to add liquidity combinations of AAVE + ETH in Balancer liquidity pools to obtain ABPT tokens, which can then be staked in the AAVE protocol's safety module for staking rewards and additional BAL rewards and trading fee income. The safety module also provides additional security incentives to encourage more participation in staking activities.

(3) What is the AAVE Safety Module?

The AAVE Safety Module protects the protocol from unexpected financial losses during shortfall events. Shortfall events typically include:

- Smart Contract Risks: Risks of errors, design flaws, or potential attack surfaces in the AAVE smart contract layer.

- Liquidation Risks: Risks of collateral assets used on AAVE failing; liquidators failing to seize liquidation opportunities in a timely manner; or low market liquidity for the assets to be repaid.

- Oracle Failure Risks: Risks of the oracle system failing to update prices correctly during extreme market downturns and network congestion; or risks of the oracle system incorrectly submitting prices, leading to improper liquidations.

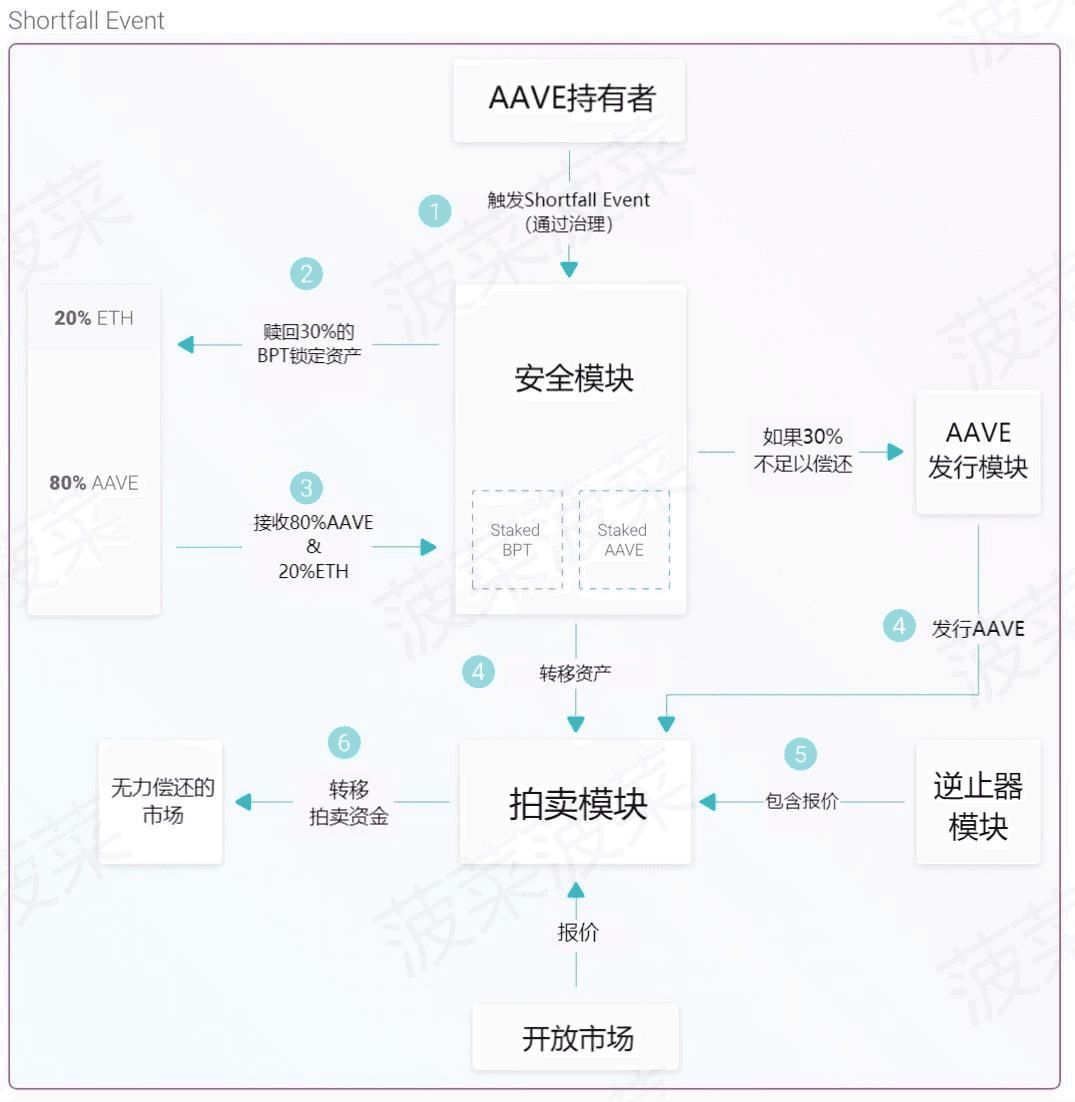

If a shortfall event occurs, the safety module will use up to 30% of the locked staked assets to auction off to cover the deficit. If the amount seized from the safety module is insufficient to cover all debts, a temporary mechanism called Recovery Issuance will be triggered to mint additional AAVE and use it along with the funds extracted from the safety module to cover the deficit.

The auction module will auction AAVE and ETH from the safety module in batches following a Dutch auction method, with the scale depending on the deficit to be covered. At this point, the Backstop Module will be activated. The Backstop Module is a deposit pool based on smart contracts that allows stablecoins or ETH to be deposited at an agreed price as purchase orders for AAVE tokens in the event of shortfall events, acting as the last buyer. When the auction price falls below the agreed price in the Backstop Module, the orders in the Backstop Module will be executed.

In simple terms, participants in the AAVE protocol's safety module staking bear up to 30% of the overall safety risk of the protocol in exchange for staking rewards and security incentives from the ecosystem reserve fund.

4. The New Challenger of Decentralized Stablecoins—GHO#

(1) What is the decentralized stablecoin GHO?

On July 8, 2022, the AAVE community released a new proposal to introduce GHO, a decentralized stablecoin pegged to the US dollar, generated through over-collateralization with continuously yielding assets. As a leader in the DeFi lending space, the news of AAVE launching a stablecoin is bound to attract significant attention. Currently, we can learn about some mechanisms of GHO from the community proposal:

- GHO will be decentralized.

- GHO will be generated through over-collateralization with assets that provide continuous yield.

- GHO will be supported by various types of collateral within the AAVE protocol.

- GHO will be governed by the AAVE community.

- Participants in the safety module (stkAAVE holders) can mint GHO at a discounted rate.

- GHO introduces the concept of "facilitators," allowing for the generation or destruction of GHO without trust.

- GHO introduces a Portal that will provide an ideal path for expanding GHO in a multi-chain world.

In simple terms, users can generate the decentralized stablecoin GHO while earning interest from collateral specified by AAVE governance in the AAVE protocol. When users want to redeem their collateral, they must burn the minted GHO to redeem it. The interest rate for GHO is adjusted through AAVE community governance, and stkAAVE holders participating in the AAVE safety module can enjoy discounted rates for generating GHO.

Unlike the current leader in decentralized stablecoins, DAI, GHO's collateral can provide continuous yield. Additionally, AAVE introduces the concept of a "facilitator," designated by the AAVE community through governance, typically a protocol or institution. Facilitators can generate or destroy GHO without any collateral based on different strategies to regulate the market. However, each facilitator has a bucket, and the AAVE community decides the upper limit of GHO that each facilitator can generate. The AAVE protocol itself will serve as the first facilitator.

GHO introduces the ability to achieve liquidity across chains through the Portal. By using the Portal, GHO can be distributed across networks without trust, with the entire process requiring only simple messaging rather than using bridges, thereby reducing overall risk. Facilitators deployed and activated by the Aave community may be allowed to redistribute GHO across various networks.

(2) Why does AAVE want to create a stablecoin? Can it surpass DAI?

Stablecoins hold an irreplaceable position as value carriers and mediums of exchange in the entire crypto space. However, creating a stablecoin is not an easy task. A stablecoin that lacks sufficient liquidity and user volume is difficult to sustain. This typically requires the issuer of the stablecoin to have enough influence, liquidity, and user volume to possess capital. For the DeFi lending leader AAVE, this does not seem to be a concern. Launching a stablecoin can not only enhance AAVE's competitiveness in the industry but also attract more users and revenue.

First, since GHO is minted through over-collateralization of assets deposited by users in the AAVE protocol, the demand for GHO will encourage more users to deposit assets in AAVE. Additionally, stkAAVE holders participating in the safety module can obtain discounted rates for minting GHO. Discounted rates mean that when GHO's price deviates, arbitrage can be performed, effectively empowering stkAAVE holders and incentivizing more users to participate in staking in the safety module. Since the safety module's role is to mitigate AAVE's bankruptcy risk and protect the funds of liquidity providers, the more staking in the safety module, the stronger AAVE's risk resistance becomes. At the same time, the increased demand for AAVE will bolster its price, and the interest generated by GHO will become a new source of income for the AAVE protocol. Therefore, launching GHO can significantly enhance AAVE's competitiveness.

However, GHO still faces some risks. First, GHO is subject to the same scrutiny risks as DAI. Centralized stablecoins will inevitably occupy a large proportion of collateral. If the issuing institution of the centralized stablecoin blacklists the protocol, it will face the risk of collapse, similar to DAI. Secondly, for facilitators, the right to mint GHO without any collateral is overly centralized. If the designated facilitators, such as institutions or organizations, experience defaults, it could trigger the risk of GHO losing its peg. On the other hand, even though the bucket mechanism limits the upper limit of GHO that facilitators can generate, the designation of facilitators and the buckets are determined through voting based on AAVE's voting weight. If the interests involved are too significant, it may lead to governance becoming increasingly centralized or collusion among governors. Moreover, for founders and holders who acquire large amounts of AAVE at very low costs, GHO essentially acts as a money printer, allowing them to cash out AAVE's market value using GHO, which could lead to risks similar to the LUNA collapse.

Mechanically, GHO's minting mechanism is more attractive than DAI's because GHO allows the collateral assets used for minting to be lent out to earn interest. The increased demand for participation in safety module staking to enjoy discounted rates can enhance AAVE's risk resistance. However, DAI, as the leader in decentralized stablecoins, has a mechanism that has successfully passed market tests and operates stably, while GHO has yet to be launched and tested in the market, increasing many uncertainties. Whether GHO can surpass DAI remains unknown, but as the leading lending protocol, AAVE's stablecoin is certainly worth looking forward to.