As blockchain technology continues to develop, many applications born on the blockchain that may disrupt traditional industries are constantly emerging, which has attracted massive funding to this market. For both institutions and individuals, entering the crypto market inevitably revolves around one thing: centralized stablecoins.

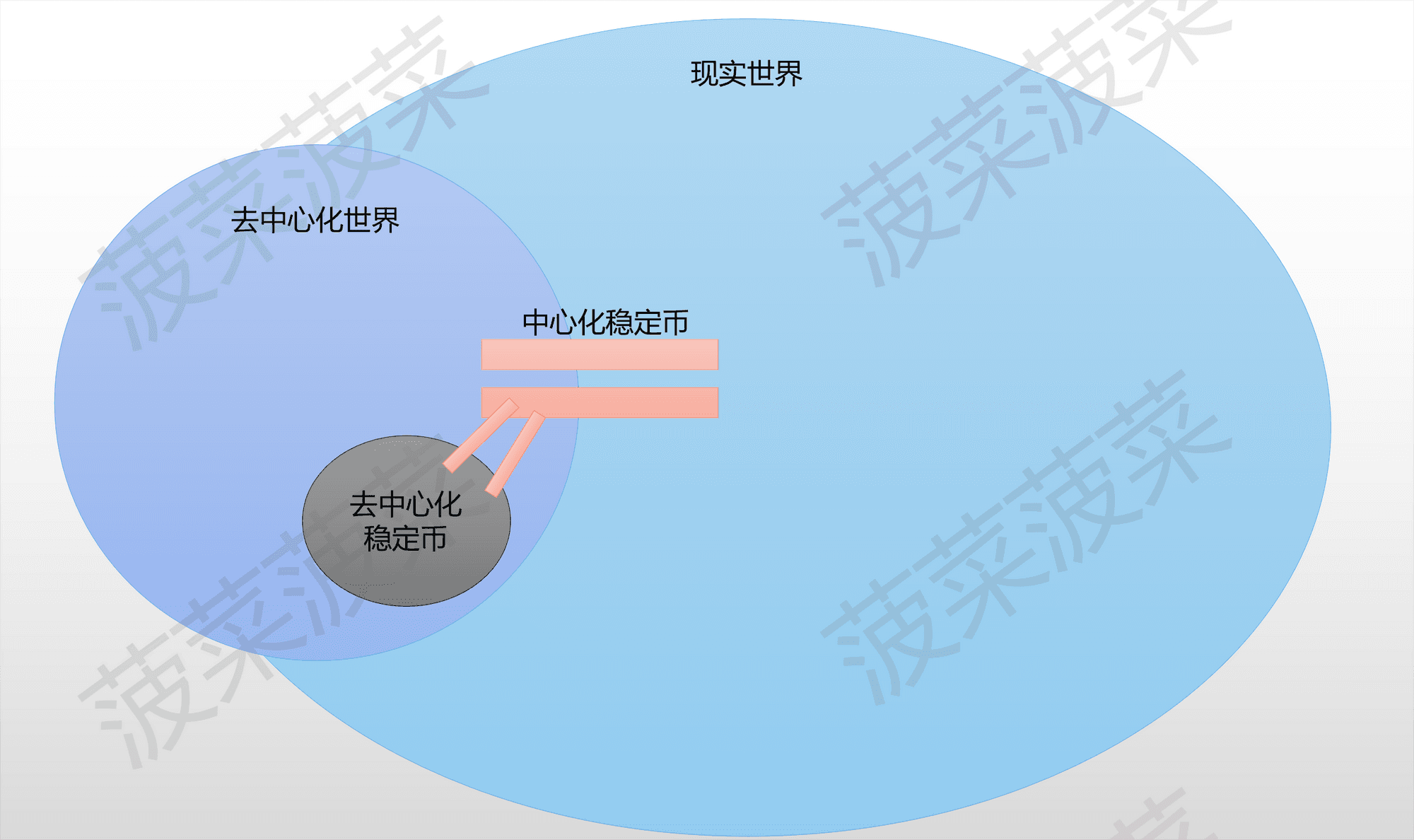

Centralized stablecoins provide a bridge between the real economy and the blockchain world, serving as a value mapping of traditional finance in the crypto world. They offer a stable value carrier, and the emergence of centralized stablecoins has propelled the development of the blockchain world. However, as the scale of centralized stablecoins continues to expand, blockchain is also facing a contradiction with the spirit of "decentralization."

This article is solely a personal analysis and does not constitute any investment advice. Please feel free to point out any inaccuracies.

Authors: Spinach Spinach, Unlicensed Scholar Sumo

Table of Contents#

I. Stablecoins—Value Mapping Between Off-Chain and On-Chain Worlds#

(1) What are stablecoins?

(2) What is the significance of stablecoins?

II. Are mainstream stablecoins a continuation of US dollar hegemony?#

(1) What is US dollar hegemony?

(2) How is US dollar hegemony formed?

(3) How do mainstream stablecoins perpetuate US dollar hegemony?

(4) Why does the US accept challenges to its minting power in the crypto world while other countries do not?

III. Where should the decentralized stablecoin ecosystem head?#

(1) The dilemma of "decentralization"

(2) A gray future

- Stablecoins are on-chain crypto assets pegged to fiat currencies. Due to their low volatility, their main role is to serve as a medium of exchange between different volatile crypto assets and as a stable store of value.

- The significance of centralized stablecoins lies in their low volatility, which allows them to act as a "safe haven" during market turbulence and as a medium of exchange that greatly improves trading efficiency, providing a secure value carrier for the entire crypto market to accommodate larger amounts of capital.

- Decentralized stablecoins cannot serve as stable value stores like centralized stablecoins; they are more like leverage tools. People obtain decentralized stablecoins by collateralizing assets to increase asset leverage and capital efficiency, using the decentralized stablecoins generated from collateral to purchase volatile assets or earn interest.

- US dollar hegemony originates from the US's strongest comprehensive national power from World War II to the present. After the collapse of the Bretton Woods system, the dollar quietly transitioned from the gold standard to a sovereign credit standard, with the monetary scale expanding over 100 times in 50 years. It seems that the human fiat currency system has been completely broken, heading toward an unknown outcome.

- The establishment of the Bretton Woods system played a crucial role in the stable recovery of the world economy. The emergence of US dollar hegemony also prevented the currencies of various countries from falling into a vicious cycle of competitive devaluation, leading to significant fluctuations in global exchange rates and chaotic trade. During this phase, the US played a referee role in the global political and economic environment, providing important public goods for post-war global economic recovery, which has its positive significance.

- Centralized stablecoins, as a reflection of the real-world dollar, are the best bridge for US dollar hegemony to exert influence over the crypto world. The dollar hegemony can not only directly shake the entire crypto world through stablecoins, but almost all centralized stablecoin issuing institutions are under the control of US regulation, allowing them to freeze and sanction on-chain stablecoins at will.

- The reason the US chooses to accept and support challenges to its minting power in the crypto world is that the dollar, as a stablecoin, can not only harvest using the absolute advantage of dollar hegemony but also stubbornly maintain the status of dollar hegemony while avoiding the risk of other countries undermining the dollar's foundation in the crypto world.

- For decentralized stablecoins, it seems there are only two paths: one is to yield to centralized stablecoins and become a tool for "increasing capital efficiency," continuously finding ways to expand their scale and attract more users; the other path is to explore true "decentralization," which is the most challenging road.

I. Stablecoins—Value Mapping Between Off-Chain and On-Chain Worlds#

(1) What are stablecoins?

Stablecoins are on-chain crypto assets pegged to fiat currencies. Due to their low volatility, their main role is to serve as a medium of exchange between different volatile crypto assets and as a stable store of value. Stablecoins are mainly divided into centralized stablecoins and decentralized stablecoins:

Centralized stablecoins: Crypto assets issued on-chain by centralized issuing institutions, backed by off-chain assets. They often promise that their issued "digital dollars" (such as USDT, USDC) can be exchanged for real dollars at any time, serving as a value mapping of the real economy entering the blockchain world. Centralized issuing institutions typically hire independent accounting firms or auditing agencies to regularly verify the reserve assets in custodial accounts, ensuring that the total value of their reserve assets exceeds the value of the issued "digital dollars" (i.e., the company's liabilities).

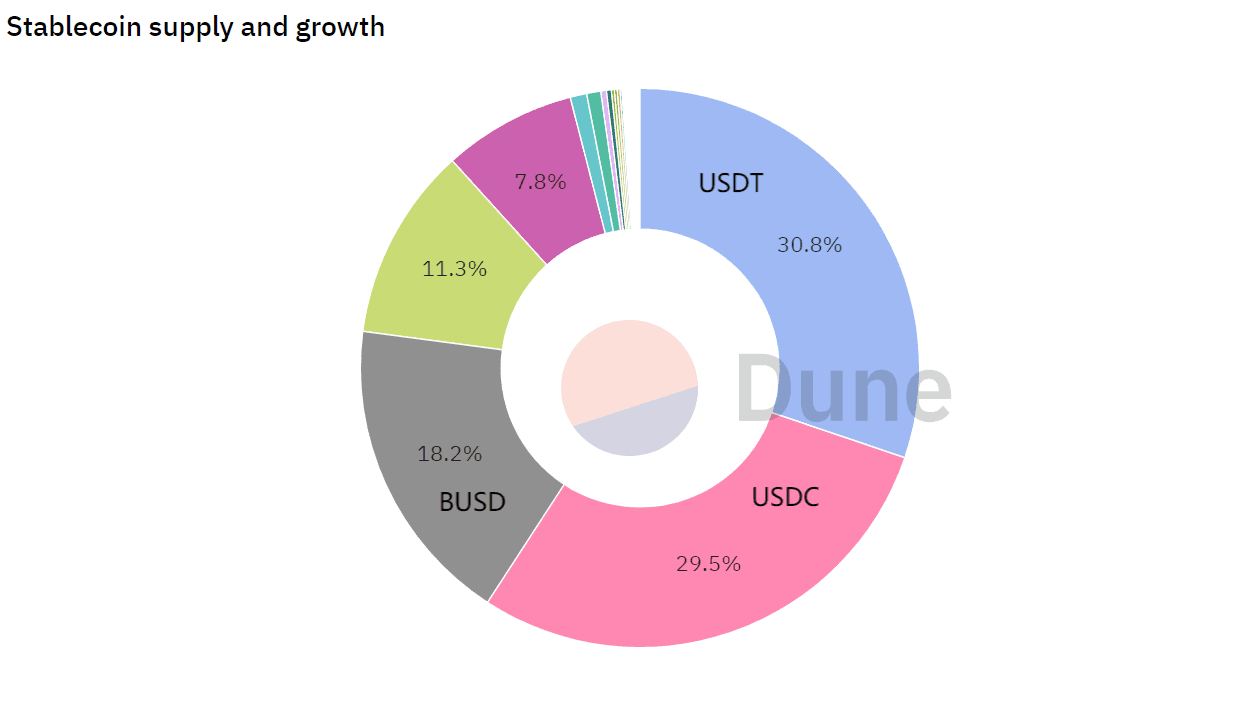

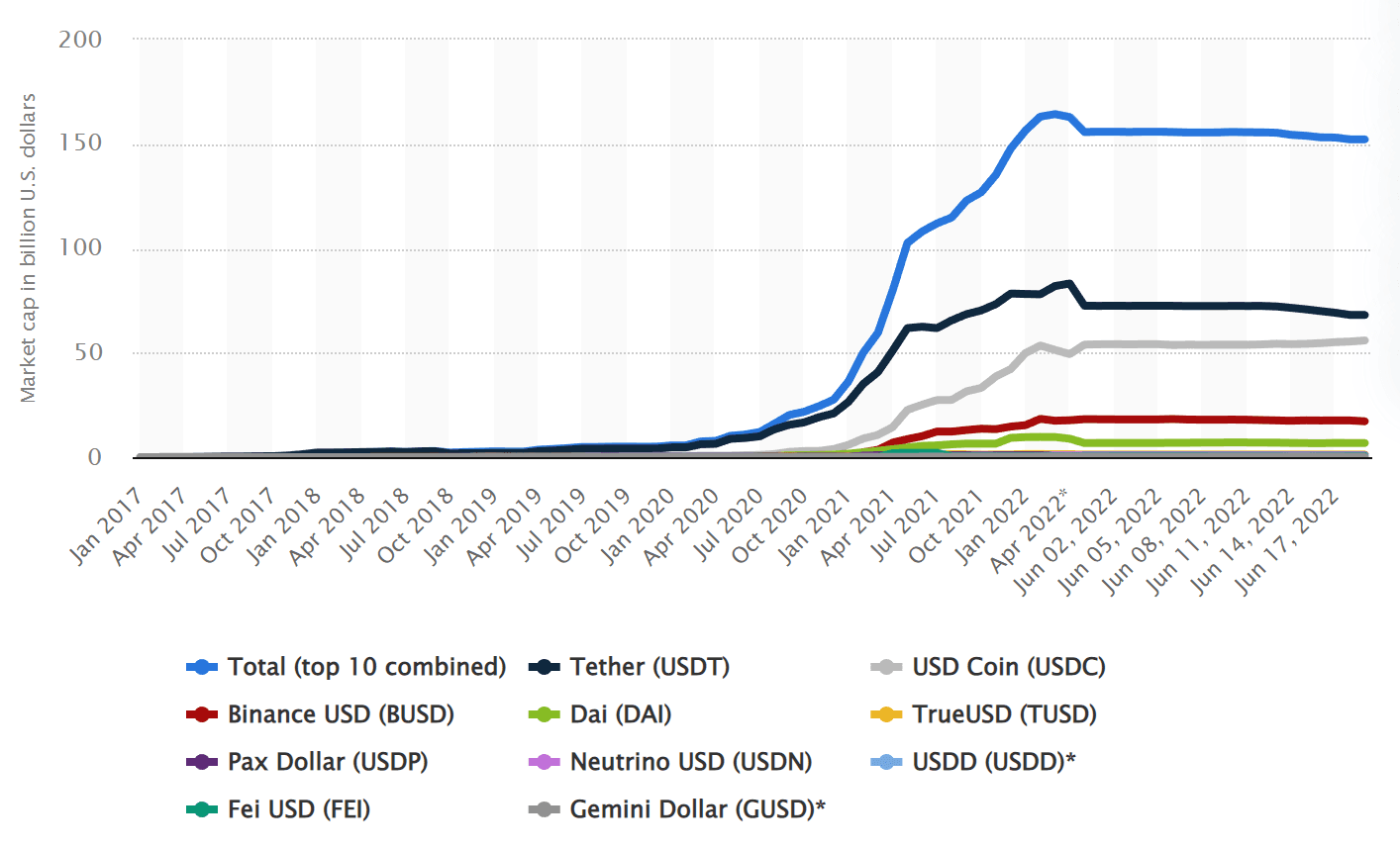

Currently, the largest scale of centralized stablecoins is USDT issued by Tether, but the company has long been embroiled in controversies over asset transparency and has failed to provide formal audit reports for several years, only beginning to release audit reports publicly in the first half of 2021. Additionally, USDC, issued by a joint venture of Circle and Coinbase, and BUSD, issued in cooperation with Binance and Paxos and approved by the New York State Department of Financial Services (NYDFS), have rapidly developed this year due to their greater compliance, together occupying a significant portion of the crypto market. As of August 26, 2022, the combined market shares of USDT (30.8%), USDC (29.5%), and BUSD (18.2%) have exceeded 75% of the entire stablecoin market.

Data source: https://dune.com/hagaetc/stablecoins

Decentralized stablecoins: Crypto assets generated through over-collateralization or algorithmic means, not issued by centralized entities, but generated through self-executing smart contracts running on-chain, often governed in the form of decentralized autonomous organizations (DAOs). Unlike centralized stablecoins, the issuance of decentralized stablecoins does not lead to an expansion of market scale, which is related to their generation method.

Over-collateralized stablecoins represented by MakerDAO's DAI are generated by locking up recognized on-chain volatile assets as collateral, such as generating $5,000 DAI from $10,000 worth of BTC. Essentially, the liquidity in the market does not increase. In contrast, algorithmic stablecoins that are not backed by collateral are even more unstable, as exemplified by Terra's LUNA and UST. The model of mutual anchoring between LUNA and UST, which creates value out of thin air, has significant flaws and collapsed with liquidity issues. Currently, decentralized stablecoins occupy a relatively small market share, with MakerDAO's DAI being the leader in this field. As of August 26, 2022, DAI's market value ranks just behind USDT, USDC, and BUSD, with a total supply of 6,972,989,621, approximately 10% of USDT's total supply.

Data source: https://coinmarketcap.com/zh/view/stablecoin/

(2) What is the significance of stablecoins?

The significance of stablecoins lies in maintaining price stability through pegging to fiat currencies and crypto assets, providing a stable medium of exchange between different volatile crypto assets. This greatly enhances trading efficiency and asset security. Although both centralized and decentralized stablecoins serve as stablecoins, they play different roles.

Significance of Centralized Stablecoins

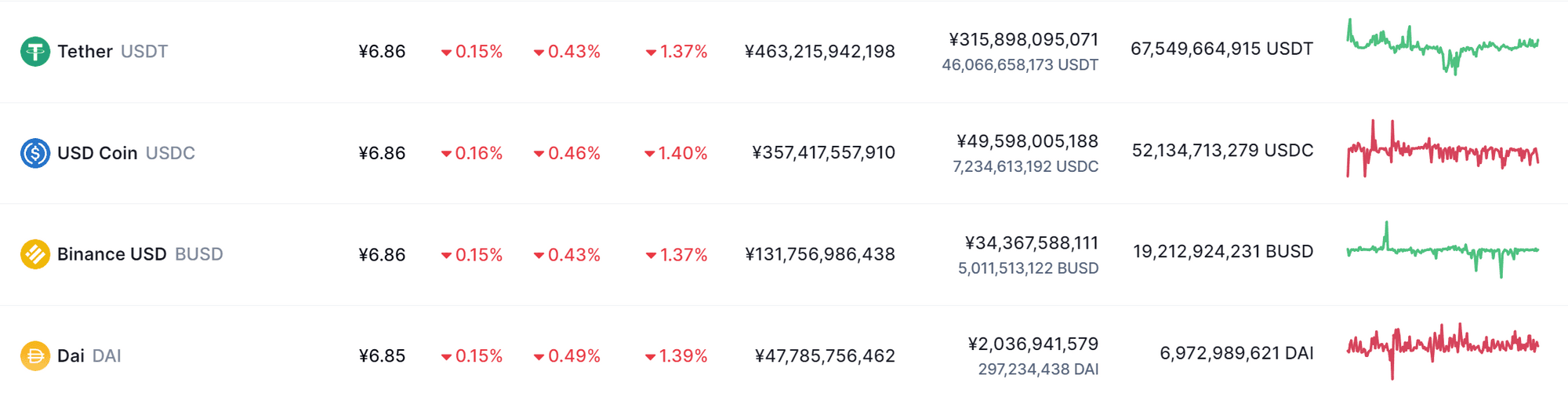

Before the emergence of stablecoins, if people wanted to purchase BTC, they had to find a seller holding BTC and directly buy the on-chain crypto asset with fiat currency, which was quite cumbersome. The purchasing process might involve: the seller providing a payment channel such as a bank account— the buyer transferring funds to the seller's payment channel— the buyer providing a wallet address— the seller transferring BTC to the buyer's address. This process could take more than ten minutes or even longer, and in the case of over-the-counter transactions, there was also the risk of the seller running away. Additionally, due to the high volatility of crypto assets, there could be significant price fluctuations within minutes, which could affect the final transaction price if severe fluctuations occurred during the trading process. For institutions, finding counterparties of corresponding scale is extremely difficult, and the likelihood of encountering seller moral hazard is quite high.

With the emergence of centralized stablecoins, both institutions and individuals can exchange fiat currency for stablecoins pegged to fiat and hold them in on-chain wallets. Therefore, the significance of centralized stablecoins lies in their low volatility, which allows them to act as a "safe haven" during market turbulence and as a medium of exchange that rapidly facilitates transactions on trading platforms, greatly improving trading efficiency and providing a secure value carrier for the entire crypto market to accommodate larger amounts of capital.

Significance of Decentralized Stablecoins

After the birth of centralized stablecoins, people attempted to create a decentralized stablecoin that is not issued by any centralized entity, completely decentralized, price-stable, highly reliable, globally applicable, and not subject to manipulation or trust crises. MakerDAO's DAI emerged as the first decentralized stablecoin, minted through an over-collateralization model and supported by a complex design to ensure that DAI's price remains stable and pegged to the dollar. In addition to over-collateralized stablecoins, algorithmic stablecoins and partially algorithmic stablecoins have also emerged. Although the variety of decentralized stablecoins has increased, it appears that decentralized stablecoins cannot replace the role of centralized stablecoins and are even highly dependent on them.

Decentralized stablecoins serve the same role as centralized stablecoins as a medium of exchange, provided that the price stabilization mechanism ensures they can be pegged to fiat currencies. However, in terms of their most important and core function as a store of value, they cannot replace the position of centralized stablecoins. Centralized stablecoins, backed by fiat currency by their centralized issuing institutions, can act as a "safe haven" during market turbulence. Regardless of market fluctuations, the price of centralized stablecoins can maintain low volatility and can be redeemed for fiat currency, while decentralized stablecoins struggle to remain unaffected during significant market fluctuations.

Currently, there are three main methods for minting decentralized stablecoins: algorithmic, over-collateralized, and partially algorithmic collateralized. Pure algorithmic stablecoins are highly unstable and carry significant risk, while over-collateralized or partially algorithmic collateralized methods require volatile assets or centralized stablecoins as collateral. If volatile assets are used as collateral, significant liquidation risks arise during market fluctuations, making them unsafe as a store of value. If centralized stablecoins are used as collateral, then the decentralized stablecoin resembles a shell of a centralized stablecoin. Although the risk of liquidation is very low, it faces the risk of protocol sanctions at any time. If the issuing institution of the centralized stablecoin imposes sanctions on the decentralized stablecoin protocol, the centralized stablecoin could face the risk of going to zero, undermining the notion of "decentralization, not subject to manipulation, and not affected by trust crises."

Currently, decentralized stablecoins find it challenging to resolve their dependence on centralized stablecoins. Most of the underlying assets of mainstream decentralized stablecoins like DAI, FRAX, and MIM are still centralized stablecoins (or liquidity tokens derived from centralized stablecoins). If collateral is replaced with volatile assets, significant fluctuations will lead to the decoupling of decentralized stablecoins, rendering them unstable. Therefore, decentralized stablecoins currently function more like leverage tools, where people obtain decentralized stablecoins by collateralizing assets to increase asset leverage and capital efficiency, using the decentralized stablecoins generated from collateral to purchase volatile assets or earn interest. This purpose has become the significance of decentralized stablecoins, and there is still a long way to go before achieving the true meaning of decentralized stablecoins in people's minds.

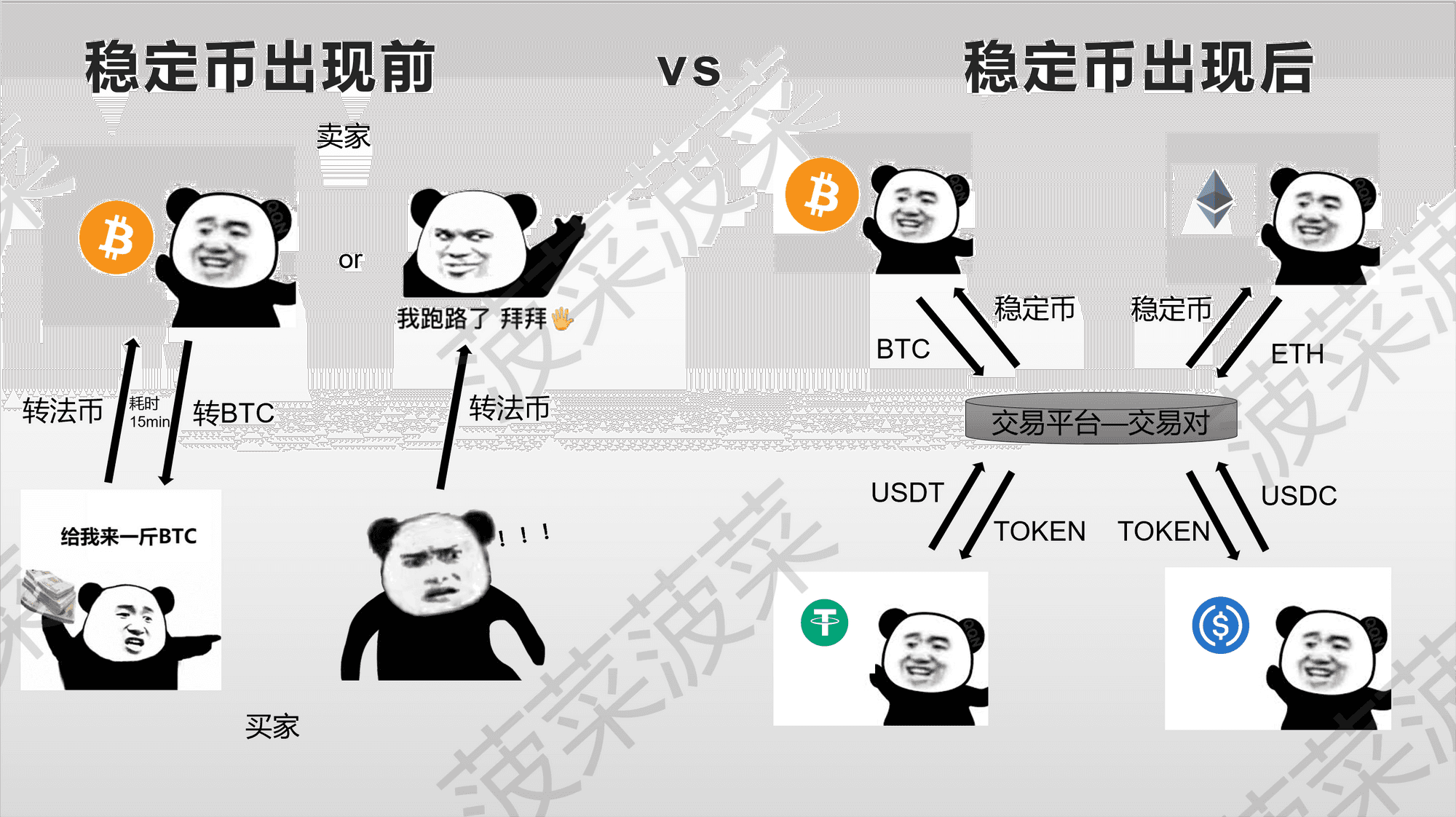

If the bridge connecting the decentralized world and the real world before the emergence of centralized stablecoins was a rickety bridge that was difficult to traverse and could not carry large amounts of capital, then centralized stablecoins are the grand bridge connecting the two worlds, allowing for smooth passage and accommodating vast amounts of capital. In contrast, decentralized stablecoins are like small bridges built on the grand bridge, providing different paths but always difficult to escape the influence of the grand bridge.

II. Are mainstream stablecoins a continuation of US dollar hegemony?#

(1) What is US dollar hegemony?

Current Situation of Hegemony

We have heard the term "US dollar hegemony" in many places, knowing that Americans can print green paper to exchange for goods and services from other countries. Every time they print money, they can transfer inflation globally, harvesting from the world. Especially recently, the euro has fallen from a previous exchange rate of 10 euros for one dollar to about 1 euro equaling 1 dollar, and the yen, which has long been considered a safe-haven currency, has also dropped to a new low in decades. However, reality often seems shrouded in a veil, making it difficult to see the essence of US dollar hegemony's harvesting.

To understand this, we need to grasp a term—Dollar Tides.

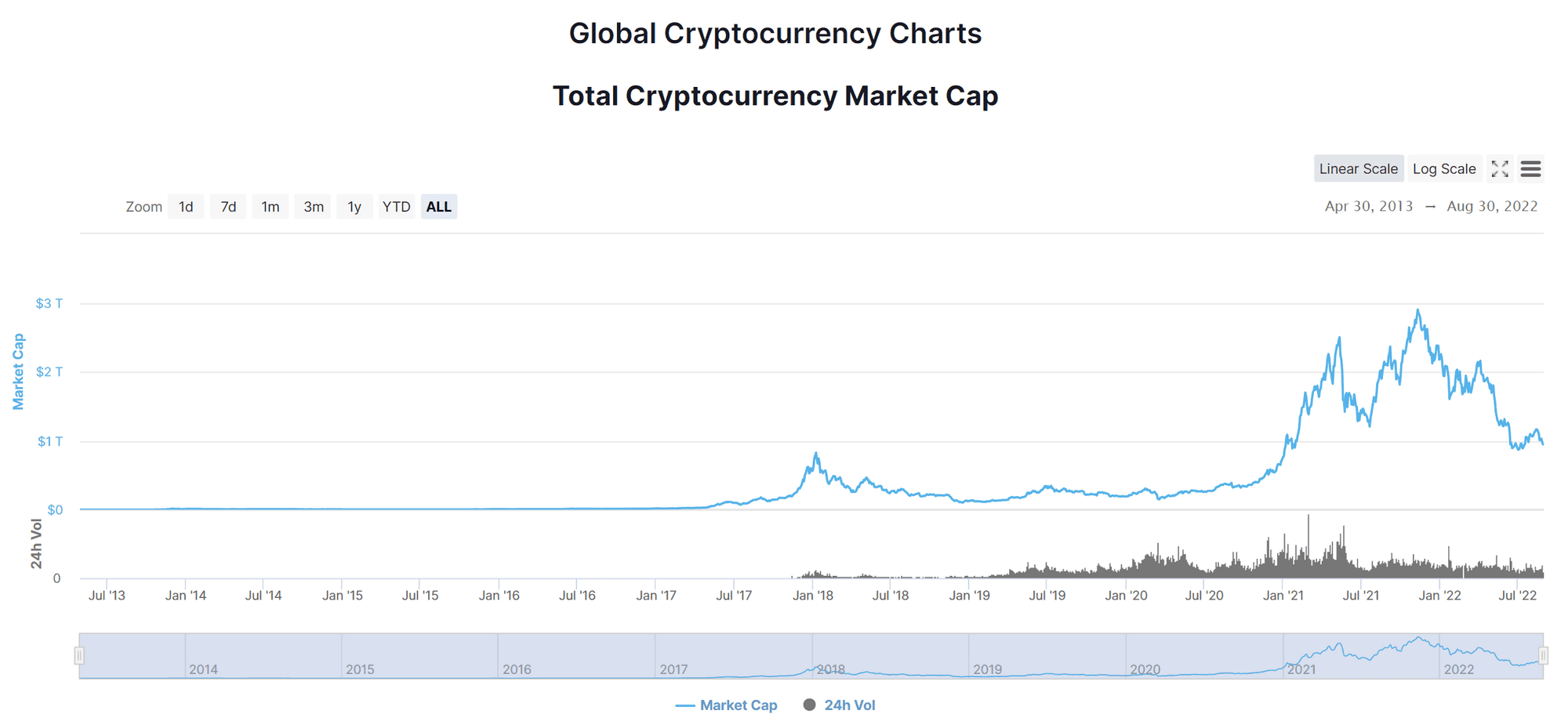

At the beginning of the pandemic, the Federal Reserve began printing money at an unprecedented rate, with central banks around the world following suit. The prices of most stock and real estate assets globally began to surge, even making people forget the historic moments of three circuit breakers in the US stock market just months prior, forgetting that this was occurring against the backdrop of a severely impacted real economy.

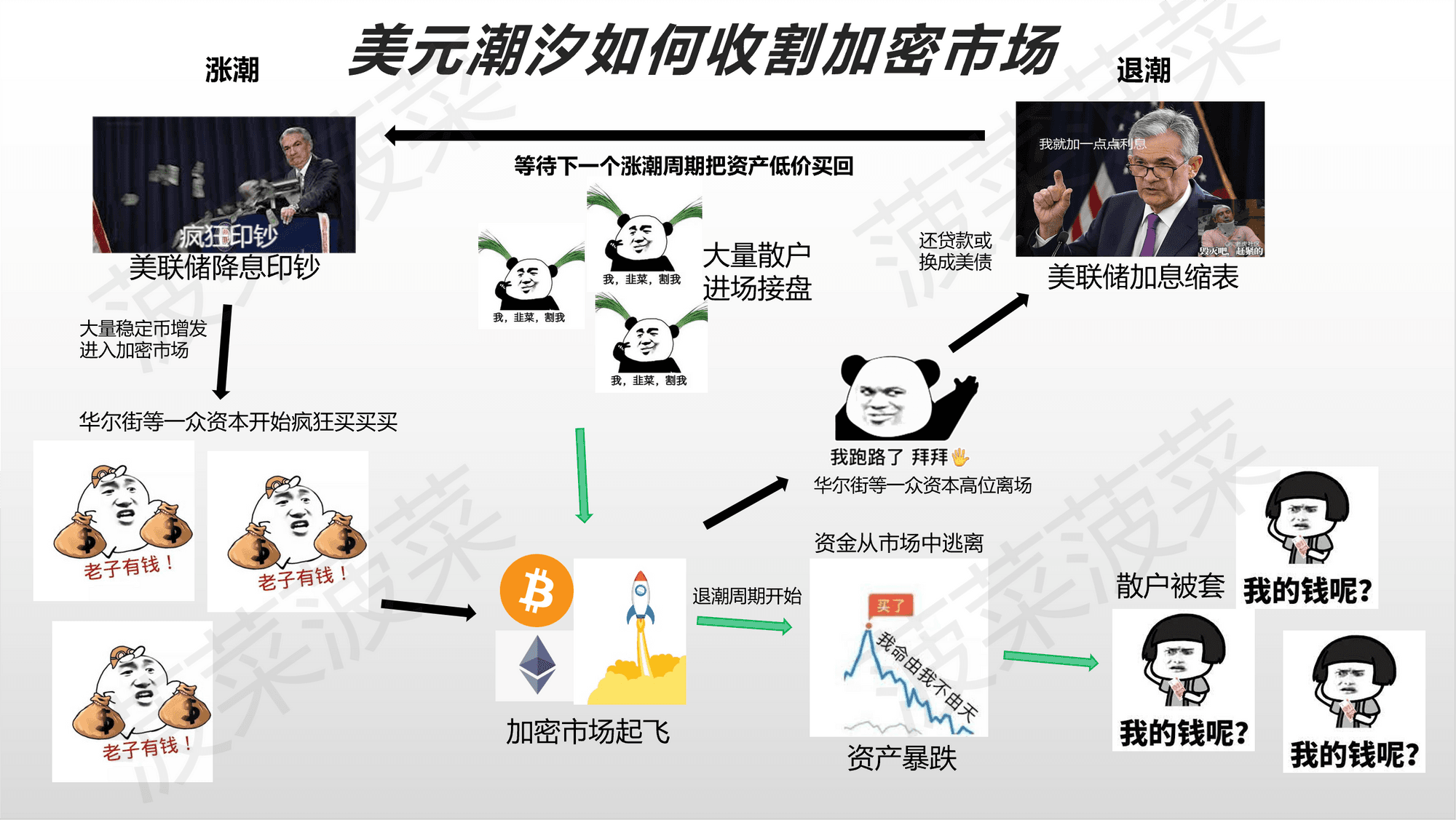

This marks the first wave of dollar tides: The Rising Tide Phase. Core areas like Wall Street received a massive influx of low-interest dollar loans, acquiring vast amounts of low-cost capital. What was the first thing they did? Of course, they bought assets everywhere, such as gold, stocks, real estate, etc. Until the prices of all traditional industry assets became too high to purchase, many funds with nowhere to go flowed into the crypto market, allowing us to witness BTC breaking through the historical high of $60,000.

If we observe the trend of the entire crypto market's market capitalization, we can see that since the Federal Reserve began printing money in 2020, major centralized stablecoin issuing institutions have continuously increased the issuance of stablecoins, leading to a corresponding rise in the market capitalization of the entire crypto market, reaching historical highs. This is a key reason for this bull market.

Data source: https://www.statista.com/statistics/1255835/stablecoin-market-capitalization/

Data source: https://coinmarketcap.com/charts/

This rising tide is not a coincidence; historically, such moments occur cyclically. During such times, the low-interest dollar capital often inflates the assets of emerging markets, such as the investment bubble that arose in the 1990s when Thailand and other Southeast Asian countries absorbed Japan's industrial chain transfer. At that time, foreign investment painted a beautiful growth story, and the emerging markets of Southeast Asian countries fell into a frenzy. In the dual carnival of stock and real estate markets, early players had already quietly cashed out at high levels, taking the sweetest cream off the cake, preparing to wave goodbye and leave.

With every rise comes a fall; interest rate cuts cannot continue indefinitely, leading to the second wave: The Ebbing Tide Phase. In contrast to lowering interest rates, the natural way to reduce liquidity is to raise interest rates. This term has been powerfully emphasized in the recent months of Federal Reserve Chairman Powell's speeches; each mention causes a portion of the money in people's pockets to fly away. The following diagram briefly describes how US dollar hegemony utilizes dollar tides to harvest in the crypto market.

Looking back at historical moments, a similar situation occurred during the 1997 Asian financial crisis when capital fled. Interest rate hikes mean that borrowing costs rise; no one needs to issue a unified order. The capital from Wall Street and international hot money that borrowed massive amounts of funds knows that the party is coming to an end, and they begin to accelerate the sale of assets in peripheral markets to exchange for dollars, either to repay dollar loans or to convert them into low-risk assets like US Treasury bonds. During this process, even the domestic capital of emerging countries will begin to sell off and short their own assets, leading to a "misery loves company" scenario. At a certain point, this can even trigger currency collapses in small countries, creating opportunities for speculators like Soros to attack the Thai baht and the Hong Kong dollar. Ultimately, the wealth accumulated by emerging countries over decades is plundered in a short time.

Is the story over? The tides rise and fall, and after one round, another follows. When emerging markets are left in ruins, with numerous bankruptcies and assets plummeting, the dollar begins to lower interest rates again. Wall Street and international hot money, armed with cheap dollars, return to various countries to acquire quality assets at low prices. This cyclical rise and fall of the dollar is referred to as dollar tides. In the last ten cycles of dollar interest rate cuts and hikes, seven have ended with a recession in the real economy, with the US being the first to recover after taking advantage of the situation. The three instances that did not trigger a recession were accompanied by the plundering of weaker emerging markets. Although US dollar hegemony appears to harvest the world like a robber, there are also positive aspects behind it; everything has two sides, and this must be traced back to the origins of dollar hegemony.

(2) How is US dollar hegemony formed?

The Beginning of Hegemony

Looking back at the history of the last century, there was the global economic crisis of 1929, the most famous economic crisis in human history that began in the US and spread to Europe, causing countless people to lose their livelihoods. It also indirectly prompted countries on the brink of economic collapse to resort to war to divert conflicts, leading to the outbreak of World War II. The two world wars shattered the twilight hegemony of old Europe, and after World War II, both the victorious and defeated countries in Europe became losers burdened with massive debts.

In contrast, the US gained a respite through Roosevelt's New Deal, but the policies packaged by Roosevelt contained many contradictions, and whether they truly helped the US emerge from the economic crisis has always been a matter of debate. What is undisputed is that World War II posed little threat to the US mainland, and the enormous military orders indeed pulled the US out of the mire. Moreover, the subsequent transition from military to civilian production allowed its manufacturing and technological innovation capabilities to maintain an advantage for decades to come.

The Bretton Woods Era

In establishing the new order after World War II, the US, as one of the two remaining countries at the table and the largest creditor to European countries, naturally became the key player in establishing the post-war Western order. In 1944, the US established the Bretton Woods system, linking the dollar to gold and other currencies to the dollar, implementing a "quasi-gold standard." The dollar officially became the core currency in the global economy, also known as "greenback."

Objectively speaking, the establishment of the Bretton Woods system played a crucial role in the stable recovery of the world economy. If the US had adhered to its usual isolationism and ignored matters beyond the American continent, the weakened European countries would likely have fallen into vicious competition. The weakened national strength made printing money one of the few options for governments, and printing money equated to exchanging worthless paper for goods and services from other countries, while also devaluing the exchange rate to make domestic exports more competitive. What began as a secret attempt to print a little more would quickly escalate to a point where even printing slowly would not suffice, leading to a situation where all currencies would fall into a vicious cycle of competitive devaluation, causing significant fluctuations in global exchange rates and chaotic trade. During this phase, the US played a referee role in the global political and economic environment, providing important public goods for post-war global economic recovery, which has its positive significance.

In the past, during the gold standard era, money could not be printed indiscriminately, as the backing was gold. However, the Bretton Woods system had inherent contradictions (the Triffin dilemma). Countries needed to use dollars and hold dollar reserves, which required having dollars in the first place, but Western countries at that time lacked sufficient gold reserves to exchange for enough dollars. Meanwhile, as the most powerful manufacturing exporter, the US was facing overcapacity and eagerly awaited foreign orders to buy its products. If the US domestic dollars were lent out to other countries, the circulating dollars within the US would sharply decrease, leading to deflation, while the appreciation of the dollar would severely harm US exports.

Thus, the only solution was to print more dollars, directly providing aid and loans to foreign countries (i.e., the Marshall Plan) without affecting the circulation of dollars domestically. The dollar became the core currency in global trade, stabilizing exchange rates for post-war countries and providing stable conditions for global economic recovery while enjoying the benefits of seigniorage. While everyone was struggling to rebuild, maintaining peace was more important than being taken advantage of by the US. This situation lasted for nearly 30 years, with the dollar increasingly penetrating all aspects of the global economy. However, during this process, the US gradually played a game of ten bottles with nine caps, and after several localized wars, it squandered too much wealth, leading to a decreasing number of caps.

Post-Bretton Woods Era

The first to expose the emperor's new clothes was the pragmatic French leader de Gaulle, who loaded a warship with a large amount of dollars and exchanged them for gold, then borrowed large amounts of dollars from the market using gold as collateral, subsequently converting them back into gold. After several rounds, by 1971, France had repurchased over 3,000 tons of gold. Meanwhile, the US had played the game of printing money to the point where it had only one cap left for ten bottles, with the total US gold reserves at only $11 billion, while its external liabilities had reached $67.8 billion.

In August 1971, Nixon announced the suspension of the dollar's convertibility into gold, effectively defaulting unilaterally to the entire world. However, after being the core currency in world trade for thirty years, the dollar's status was not easily replaced, as no other currency at that time had the capability to challenge the dollar's position. The US then realized that as long as it controlled energy and food, the dollar's status would remain unshakable, leading to the establishment of the dollar-oil system, with most of the world's food and seed giants also under the control of dollar capital.

What is the Anchor?

So the question arises: what is the anchor for the issuance of fiat currencies in various countries after abandoning the gold standard?

The answer is "debt." For central banks, this refers to "sovereign debt" issued by central banks. In the balance sheets of central banks, every unit of fiat currency issued corresponds to one unit of national debt, maintaining a balance. This is theoretically a very clever new design of the human monetary system, as issuing debt incurs interest and is not without cost. Therefore, governments cannot print money recklessly like in the early fiat currency era. This sounds reasonable, but things gradually change. If you are the only referee in this game and there is no stronger authority to impose any additional costs on you, then borrowing money becomes a momentary pleasure, and you can continue borrowing indefinitely.

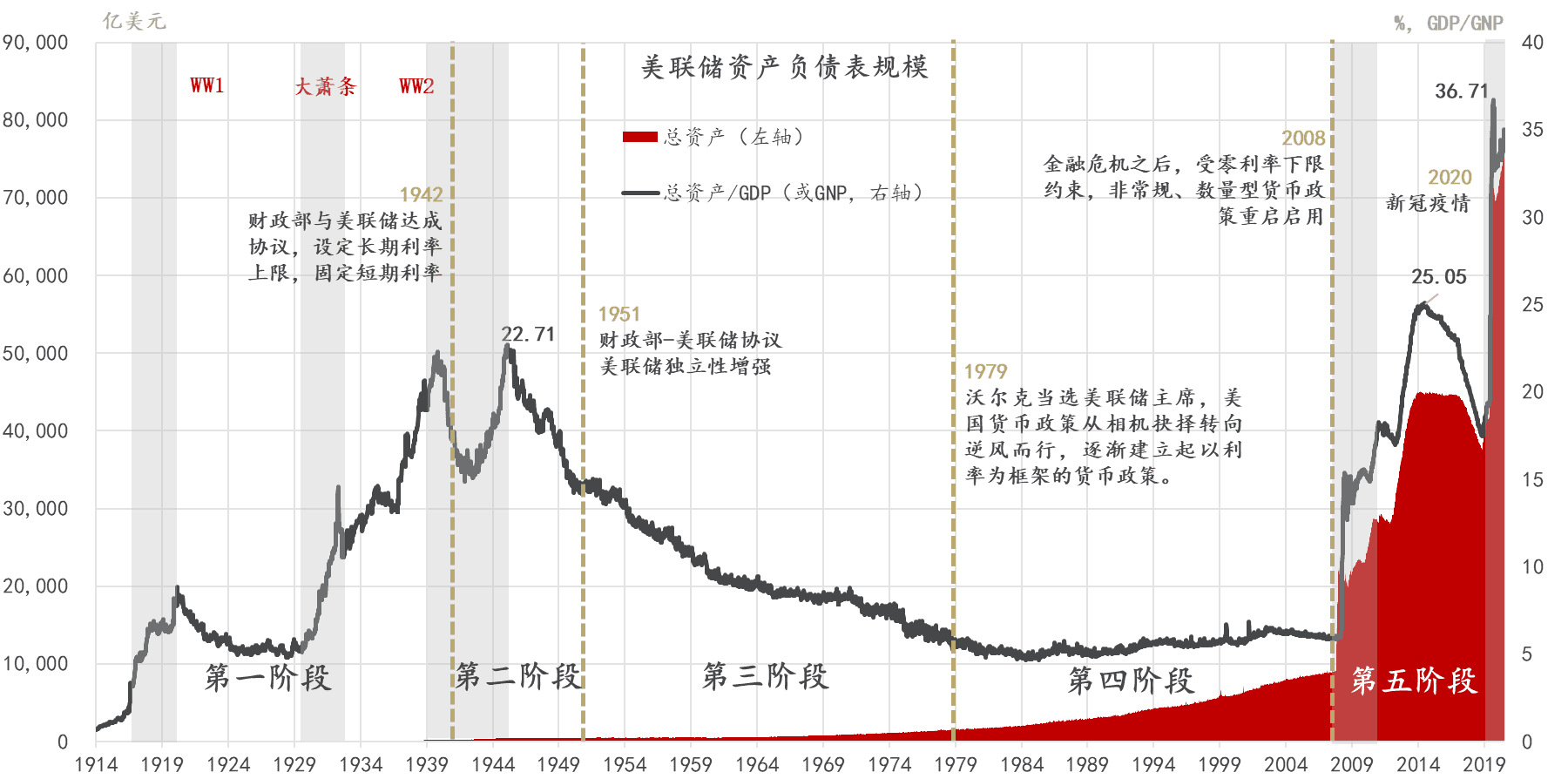

Data source: Financial Stability Center (CFS), Johns Hopkins University, Federal Reserve, Wind, Dongfang Securities Wealth Research Center

The red line in the above image represents the amount on the Federal Reserve's balance sheet (the amounts of liabilities and assets are equivalent). There is a misconception that the growth from 1971 to the early 2000s is not significant; this is actually due to the massive money printing during the 2008 financial crisis compressing the graphical representation. Excluding the data after 2008, one can still see an exponentially growing curve. Today, even the concept of Modern Monetary Theory (MMT) has gained popularity in US politics. This theory originated from the leftist fringe of economics but aligns particularly well with the thoughts of fiscal authorities. While it cannot be said to be entirely without merit, it can certainly be described as nonsensical, essentially meaning: although the dollar is the world currency, the act of printing money is an internal matter that no one has the right to interfere with. It profoundly illustrates what it means: "Our currency, their problem."

In 2020, in response to the impact of the COVID-19 pandemic, global central banks engaged in quantitative easing (QE), injecting more money into the market than all the money ever issued in human history combined! Since then, after the collapse of the Bretton Woods system, the human fiat currency system has been completely broken, heading toward a path with an unknown outcome. Let us revisit Satoshi Nakamoto's feelings during the 2008 subprime mortgage crisis, reflecting on how important it is to have a currency that is not controlled by anyone and cannot be increased indefinitely.

(3) How do mainstream stablecoins perpetuate US dollar hegemony?

At the dawn of Bitcoin's creation, Satoshi Nakamoto's hope was for Bitcoin to become a currency that could circulate in the market. Subsequently, various cryptocurrencies and trading pairs with Bitcoin indeed formed in the blockchain world. However, it is regrettable that measuring the prices of other things with a currency that itself is highly volatile is somewhat counterintuitive. Today, BTC's status struggles only in the hearts of a few hardcore players, while the market has chosen stablecoin trading pairs as the mainstream.

If we view the entire crypto world as an emerging small country, this country once attempted to implement a "gold standard" monetary system using digital gold BTC but compromised towards stablecoins after encountering various difficulties. Stablecoins are essentially a product of regulation, but we later discovered that stablecoins play a significant role in value anchoring and value circulation. Every country can issue stablecoins, but the primary focus of stablecoins remains pegging to the dollar, as the dollar has the most extensive, agile, and robust application scenarios.

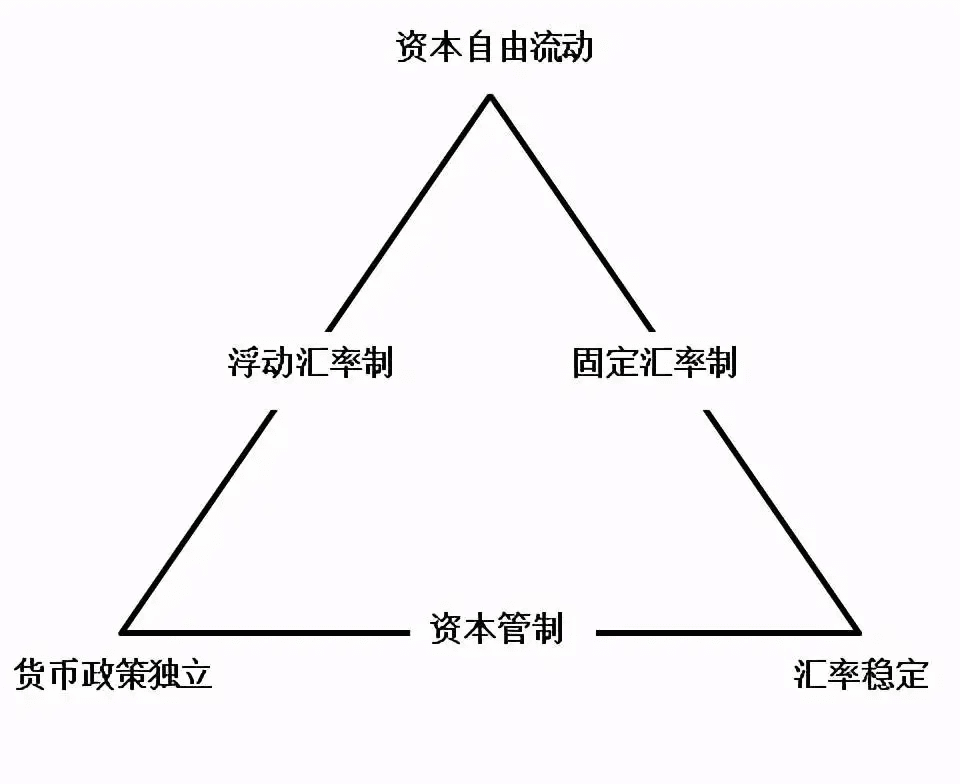

However, trading with stablecoins, especially centralized stablecoins, leads to a loss of certain sovereignty. We can understand centralized stablecoins as "vouchers" for the dollar. USDT, USDC, and similar stablecoins abandon independent fiscal policies and cannot independently adjust their interest rates and supply in the crypto world, achieving free capital flow and exchange rate stability with the dollar.

In contrast, decentralized stablecoins (algorithmic stablecoins) attempt to achieve a balance in the Mundell-Fleming trilemma, striving to maintain exchange rate stability while also ensuring as much capital freedom as possible, and greedily seeking to obtain independent monetary and fiscal policies. The most ambitious attempt to achieve this was Luna-UST, which at its peak forcibly issued over a hundred billion "dollars" at a "benchmark interest rate" of 20% without the Federal Reserve's permission, earning it the nickname "crypto Moutai." Of course, we all know the story that followed.

In reality, stablecoins, as reflections of the real-world dollar, serve as the best bridge for US dollar hegemony to exert influence over the crypto world. Just as the secret to US dollar hegemony's plundering of emerging economies is "capital freedom," choosing dollar equivalents as the mainstream for market transactions means that fluctuations in the dollar index, whether rising or falling, and the inflow or outflow of dollar tides will affect the entire crypto world through this bridge. Thus, US dollar hegemony can not only directly shake the entire crypto world through stablecoins but also that many centralized stablecoin issuing institutions are under US regulatory control, allowing them to freeze and sanction on-chain stablecoins at will.

(4) Why does the US accept challenges to its minting power in the crypto world while other countries do not?

The birth of blockchain has allowed everyone the right to issue their own crypto assets, leading to a certain degree of wild growth in regulatory gaps, creating numerous chaotic phenomena. Many countries have adopted corresponding regulatory measures to standardize this new market. Some countries have relatively lenient policies, while others are stricter. Western countries led by the US are generally more open to this, and it seems that allowing corporate entities to issue tokens like USDC or privately issued "dollars" like UST, which are not officially issued by the US government, is a challenge to its minting power. Why does the US tolerate such challenges?

First, the development of blockchain technology increasingly demonstrates its potential, and more and more people believe it is the next generation of technological revolution. US dollar hegemony not only involves harvesting from the world but also effectively gathers the most capital and the top talent globally, maintaining the best innovation environment, and has consistently made positive contributions to the research and marketization of new technologies. Unreasonably rejecting a promising technology does not align with its interests; allowing the US to remain a leader in this field and extend its technological influence is its consistent approach.

Second, leading the acceptance of the crypto world and encouraging other countries to do the same may seem to put all currencies on an equal footing with the dollar, but in reality, it places the dollar a significant step ahead. No country, even if officially endorsed, can issue legal digital currencies on the blockchain that surpass the dollar's share in the real economy. The market will always choose the dollar as the primary anchor due to its highest adoption rate in the real economy. The current situation is that stablecoins are mostly pegged to the dollar, which allows US dollar hegemony to better exert its influence over the crypto world, benefiting the dollar without any drawbacks.

Third, let us assume that the US resists the crypto world and does not allow dollars to flow into it. Other fiat currencies may not necessarily follow the dollar's decision. For example, the euro, which currently holds the second-largest market share, might strongly support blockchain technology. If several years later it hits the technological explosion, the dollar's status could potentially be overturned.

Therefore, the strategy that best aligns with US interests is akin to how companies like Google and Meta acquire everything that could potentially disrupt them. Accepting the crypto world allows the US to extend its advantages in this field rather than rejecting or suppressing it, leaving landmines for competitors to disrupt itself.

For countries outside the US, such as European countries and developed economies like Japan and South Korea, accepting the crypto world can extend their relative advantages within the existing economic system. In contrast, more peripheral economies face dilemmas because accepting it means continuing to endure the dollar's leading advantage, perpetuating their relatively backward position within the existing framework. Additionally, they may face greater systemic financial risks due to the opening of capital flow. For countries with foreign exchange controls, their monetary policies have already made trade-offs, sacrificing capital freedom to ensure exchange rate stability and independent fiscal policies, which cannot be balanced simultaneously. Accepting the crypto world essentially requires them to have all three, which contradicts their monetary policies.

III. Where should the decentralized stablecoin ecosystem head?#

(1) The Dilemma of "Decentralization"

Many believers in the "spirit of decentralization" are attempting to create a stablecoin that originates from the crypto world itself to escape the control of US dollar hegemony over the crypto world. We can see many attempts, such as algorithmic stablecoins like BasisCash with its three-token model, the simpler Luna-UST dual-token model, and Ampl, which attempts to abandon the dollar and instead anchor the entire cryptocurrency itself. These were once referred to as Rebase stablecoins because their technical characteristics aimed to automatically return prices to normal through changes in market supply and demand after decoupling. However, ultimately, these attempts seem to have failed.

The most promising may be over-collateralized stablecoins like DAI and sUSD, which maintain relatively reliable performance due to their clear stability rules based on smart contracts. They were once referred to as algorithmic stablecoins, but after the UST collapse tarnished the reputation of algorithmic stablecoins, they are now distinguished as over-collateralized stablecoins. To date, over-collateralized stablecoins have maintained relatively reliable performance because they always have sufficient collateral to support their value.

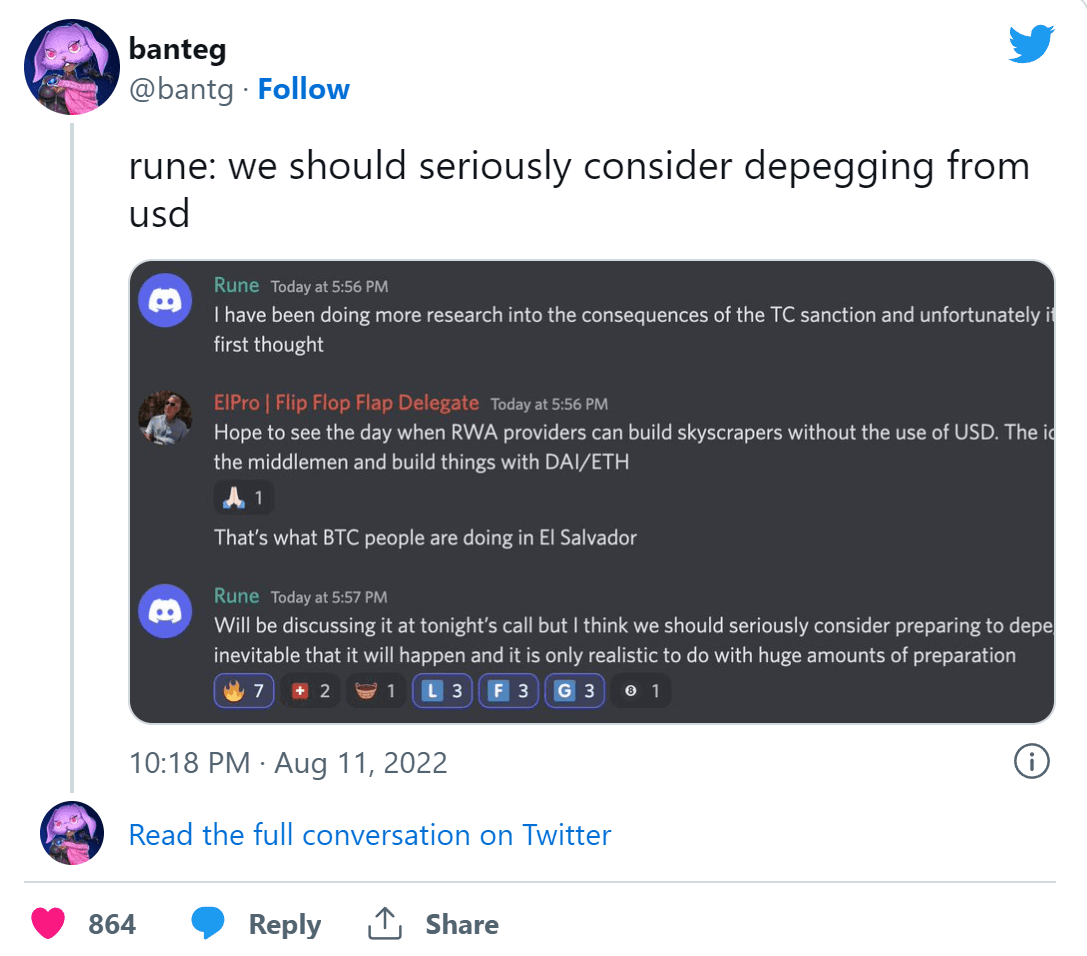

After Tornado Cash was sanctioned by OFAC, the first-ever protocol sanction marked a significant turning point for the entire crypto industry, entering an unknown realm of regulation. This poses an unprecedented sense of crisis for decentralized stablecoin protocols. If decentralized stablecoin protocols relying on centralized stablecoins for collateral are sanctioned, it essentially signifies the death of the entire project. Rune, the founder of MakerDAO, and core community members have recognized this risk and are considering promoting the decoupling of DAI from centralized stablecoins, using ETH as collateral to prevent the risk of MakerDAO being sanctioned.

Image source: Twitter

If stablecoins are generated purely using ETH as collateral, this purely straightforward path also faces insurmountable difficulties, as it is long-term constrained by the volatility of the underlying assets, making it prone to decoupling and liquidation. The market scale also struggles to grow, falling into a vicious cycle where it is not very usable, leading to fewer people collateralizing for minting, resulting in a smaller supply, which makes it even harder to use.

However, if MakerDAO continues to use centralized stablecoins as collateral for stability, it will always be controlled by the US government behind the centralized stablecoins. If one day DAI grows to threaten the position of dollar hegemony, the Federal Reserve could easily freeze all its centralized stablecoin assets under the pretext of "non-compliance with regulations," stripping it of any qualification to compete with dollar hegemony—though it never truly possessed such qualifications from the beginning.

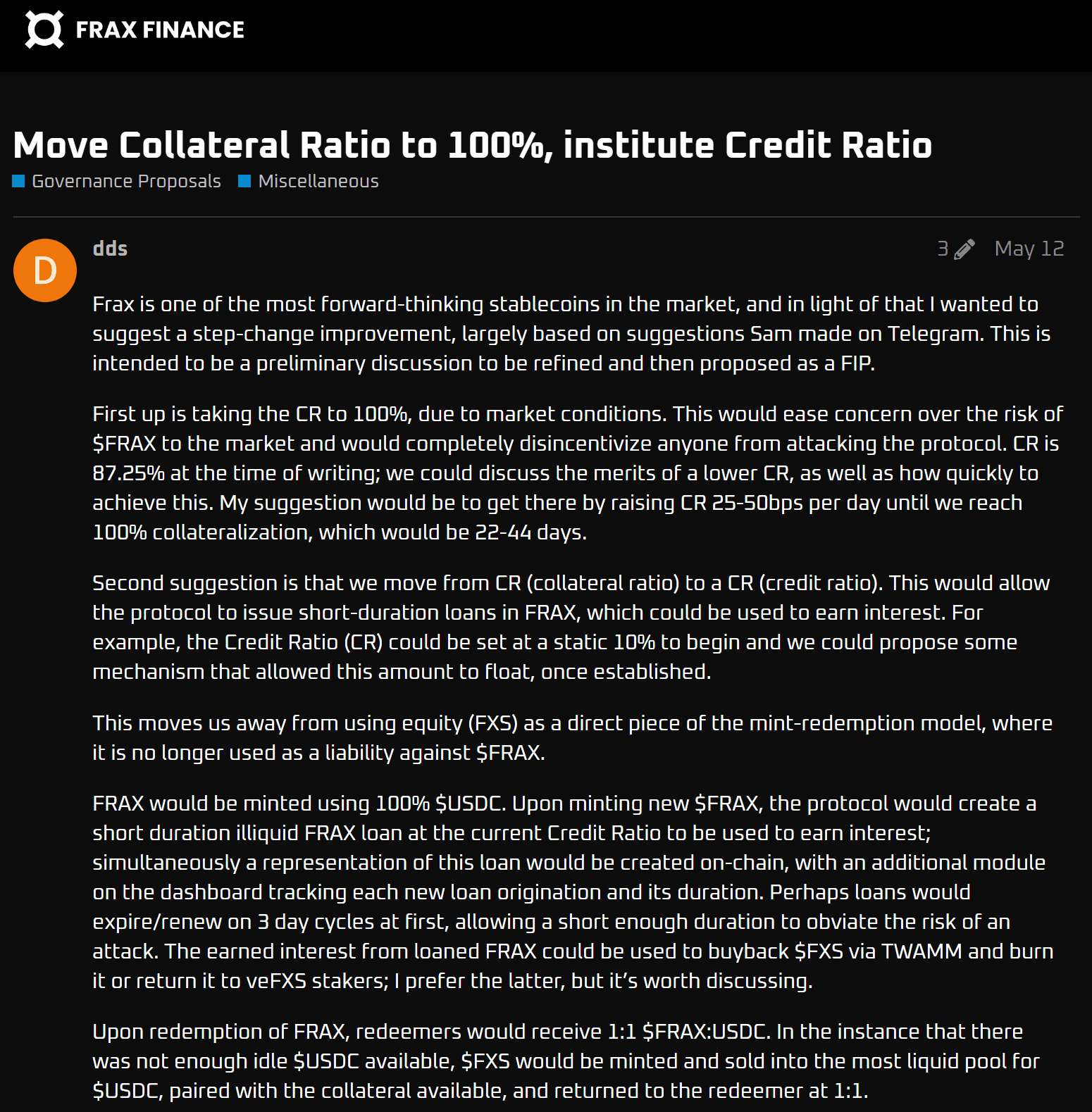

For FRAX, the second-largest decentralized stablecoin by market capitalization, it seems there is little room for struggle. Since its inception, FRAX has used a partial algorithmic approach with centralized stablecoins as the main collateral, paired with a certain ratio of governance tokens to generate FRAX. Before Tornado Cash was sanctioned, the FRAX community had already proposed to raise the collateral ratio to 100%, meaning that minting FRAX would no longer involve a certain ratio of centralized stablecoins and governance tokens, but rather 100% centralized stablecoin collateral. This move seems intended to enhance FRAX's underlying credit to achieve scale expansion, attracting more users to use FRAX, but it simultaneously becomes more reliant on centralized stability.

Proposal source: https://gov.frax.finance/t/move-collateral-ratio-to-100-institute-credit-ratio/1371

(2) A Gray Future

For decentralized stablecoins, it seems there are only two paths: one is to yield to centralized stablecoins, becoming a tool for "increasing capital efficiency" and continuously finding ways to expand their scale to attract more users. Projects choosing this path may not care about whether they are decentralized but rather about increasing protocol revenue by attracting more users. The other path is to explore true "decentralization," which is the most challenging road, the goal that true believers in blockchain spirit aspire to. For MakerDAO, which is moving toward "decentralization," the future is a gray one. MakerDAO not only faces the potential for protocol sanctions at any time but also risks project collapse due to failed transitions, making the road long and arduous.

Although the crypto world seems to be moving against the "spirit of decentralization," it is difficult for us to glimpse the trajectory of technological development at this time. Just as people in the carriage era could hardly imagine a future where cars replaced carriages, or as users of the old internet in the PC era often underestimated the disruptions brought by mobile internet, the major players from Web2 entering Web3 will also face various adaptations. The charm of this industry lies in its astonishing speed of iteration, from the earliest BTC to the "blockchain world," then to the "crypto world," and now we call ourselves "Web3." This is not just an iteration of promotional terms; it also reflects the rapid development of technology. With massive capital investment and an increasing number of builders migrating in, the future landscape will inevitably surpass the imagination of all stakeholders, and perhaps the current predicament will be resolved in unexpected ways in the coming years.